Cobalt Chart of the Month: January 2021

Cobalt Market Data / Chart of the Month

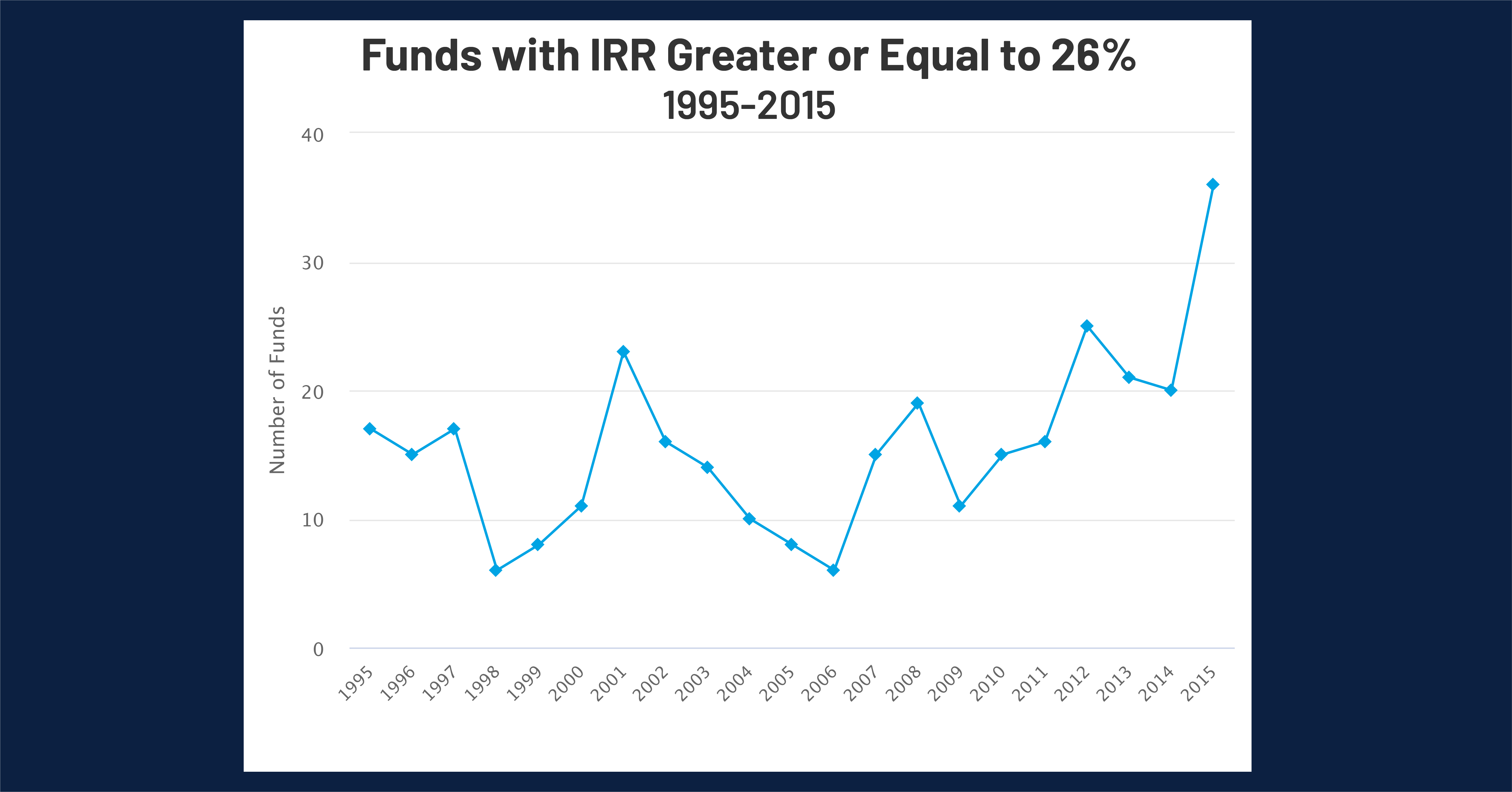

2020 is in the books and closes one of the crazier years for the global financial markets in recent history. We saw eye-popping returns in many different asset classes throughout the post-March rally. The start of the new year means time for New Year’s Resolutions, and for private equity funds that means generating superior returns. In that spirit, we wanted to understand the trends of superior-performing funds in private equity in the past to see how the number of funds with exceptional IRRs has grown over time.

In our analysis, we will be working with the Cobalt dataset from 1995-2015, including all funds with performance greater than 26%, as seen in the chart below. The past 5 vintage years have been excluded from the analysis due to high-variance IRRs early in a fund’s cycle.

New Year’s Resolutions:

Trends in the Top-Performing Private Equity Funds

Key Takeaways:

Key Takeaways:

- Early in the analysis, we see a more cyclical pattern of top-performing funds, with a steady increase through the late 90’s, followed by 5 consecutive years of decline in the 2000’s. This decline roughly tracks with the dot-com bubble in the public markets, leading to a collapse in demand and decline in top level performers throughout the next 5 years.

- Post-2009, we see a steadier trend of year-over-year increases. While the 2015 surge may regress as funds mature, and may still mark a new all-time high for funds meeting this threshold, It seems likely the upward trend will continue into the latter half of the 2010’s. Moreover, the healthy economy experienced in the latter half of the decade created a good environment for these numbers to sustain, as seen in previous cycles.

- As the bar for top performers continues to rise, there will be a greater level of competition in the market to reach these thresholds, benefitting firms and investors alike; A larger pool of funds presumably means more firms performing well and more institutional investors reaping the benefits of this performance. We have also seen the drive for superior returns reach new heights once again resulting in trends such as the IPO and SPAC frenzy, as well as continued redoubling towards traditional private equity. This leaves investors with a diversity of avenues to achieve returns, and promising firms able to achieve the best investment terms as GPs compete to fund them.

Looking Ahead

- Private Equity has long been seen as a way to create superior returns in a portfolio, and we’ve seen a growing number of funds join the elite class this past decade.

- The changes that 2020 brought to the financial landscape will be an interesting test to this growing trend, and we’ll be looking for what these implications have for the upper end of the private markets.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…