Chart of the Month: October 2021

The Hollow Pendulum: An Examination of Regional Real Estate from 2009-2020

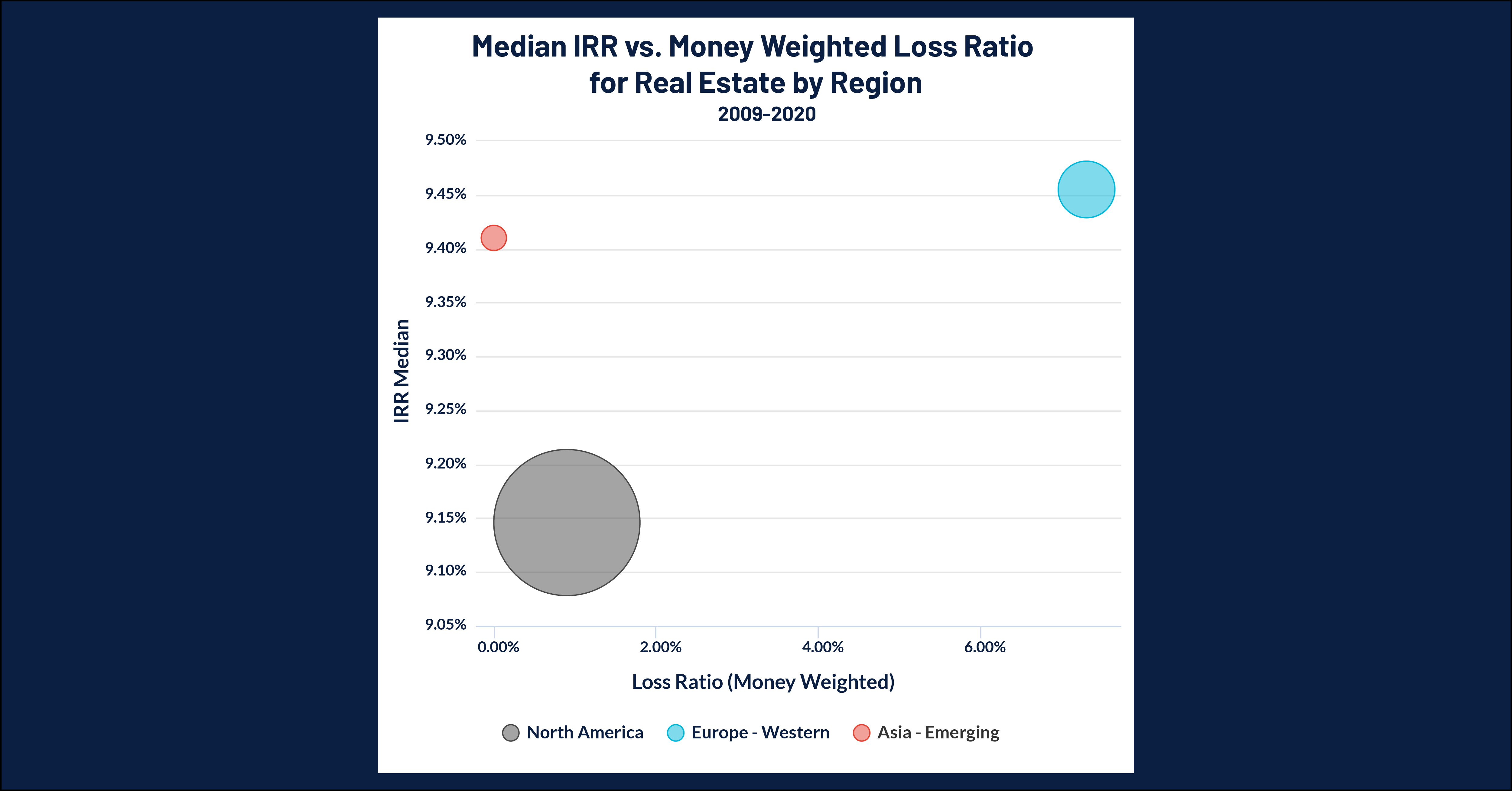

In the wake of the Great Financial Crisis (GFC), there was an incredible buying opportunity that led many private market firms to invest in the highly-distressed real estate sector. However, recent panics from the Chinese Evergrande crisis raises the question of whether or not the foundations of the recent boom are showing cracks. As such, this month’s chart analyzes real estate performance since the GFC to see how certain regions performed during the last decade with a focus on the risk taken. Specifically, we used Cobalt Market Data’s risk/return feature to compare a money weighted loss ratio to estimate risk of loss for a typical fund with a large cap bias.

Key Takeaways:

- Each of the regions we examined had relatively similar performance, with all three returning a median IRR in the 9-9.5% range. This demonstrates the safety and reliability that real estate has offered through its long-standing and stable appreciation.

- Risk-wise, we see two groups emerge. The European markets have exhibited much higher risk than the North American investments for nearly the same level of return, likely the result of European areas with stagnant or less reliable real estate markets.

- The most surprising sector, despite the low sample size, is the emerging Asia real estate. It boasts slightly higher returns than the North American juggernaut with even less apparent risk. While the higher returns are no surprise for a rapidly-developing region with high investment interest, the shockingly low accompanying risk raises questions over sustainability and completeness of data. Can this emerging market continue to outperform with little risk of failure, or are we only seeing part of the picture?

Looking Ahead:

- In light of the recent news out of the Chinese real estate market (the leader in the Emerging Asia sphere), it questions whether we are seeing this outperformance crack and revert back to a more sustainable level.

- Contrarily, the region’s continued status as “emerging” means that it will continue to attract substantial external and internal investment and could continue to deliver top line performances, perhaps with slightly higher risk allotments.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…