Chart of the Month: April 2022

The Suspension Bridge Loan: Examining European Credit Contributions

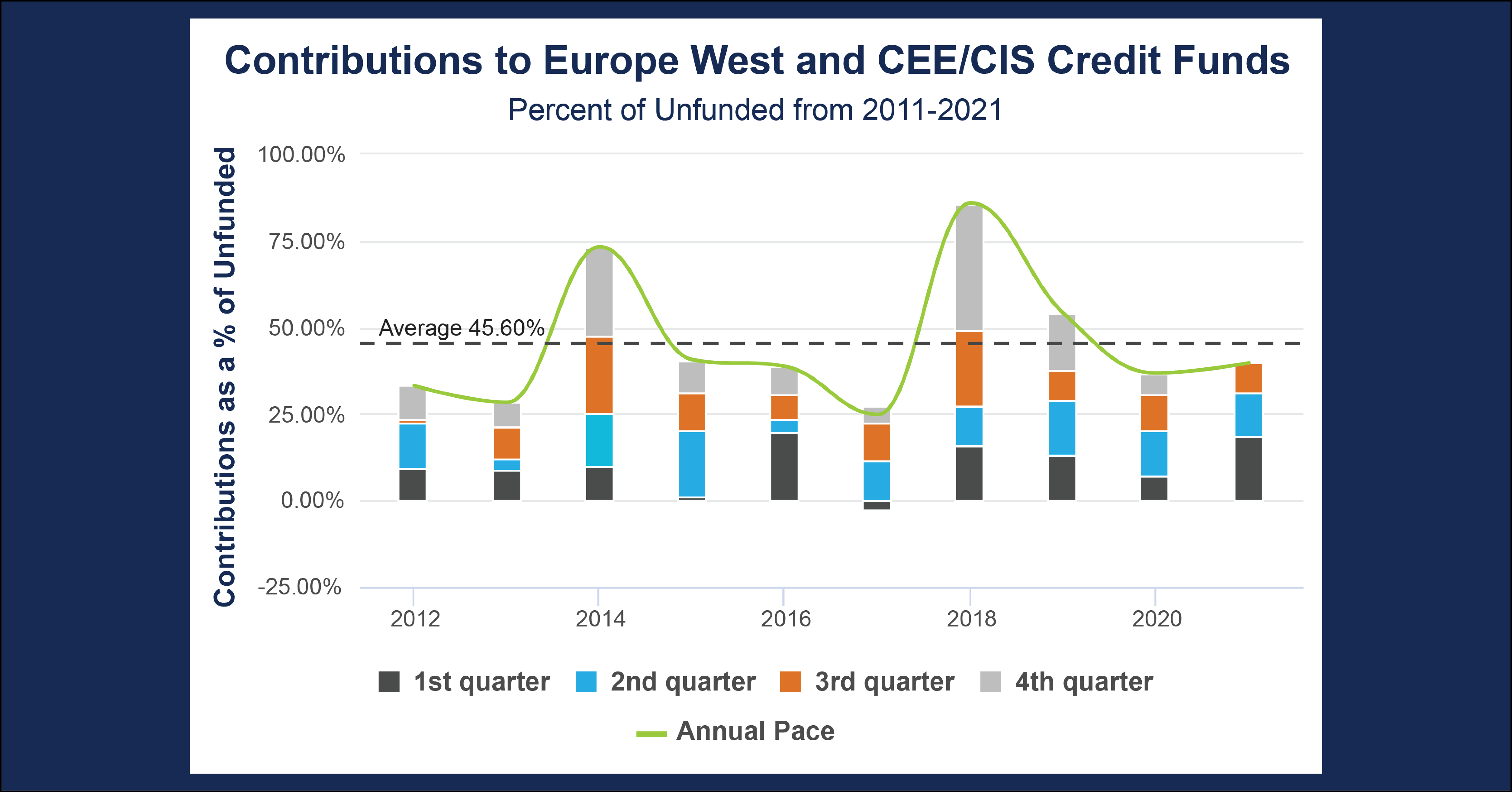

Given the recent turmoil in Europe, we wanted to examine how the level of investment into the region has changed in the past decade. Using Cobalt Market Data and Analytics Engine, we analyzed the rate of contributions to credit funds in the wake of the European debt crisis to see how investor sentiment reacts to instability in European markets.

Key Takeaways:

- There are two notable peaks of contribution in the above graph: 2014 and 2018. The first surge of investment occurred in the latter half of 2014, as GPs drew down about half of their unfunded commitments in these two quarters alone. The reasons for this are myriad, but do largely draw from the prior crises. The year saw renewed concern towards the Greek debt crisis as well as Euro devaluation against the dollar amidst an announced Fed tapering plan. 2014 also featured the climax of Ukraine’s Euromaidan unrest and conflicts with Russia. As a result, investors likely found the continent’s instability as a ripe opportunity for further investment into a temporarily distressed market.

- The second notable shift in 2018 was even more dramatic, with General Partners again piling significant contributions into credit in the latter half of the year. December of 2018 was a famously bad month in the public equity space around the globe. Europe was no stranger to these drawdowns: experiencing sideways movement throughout the year until fears of US monetary contraction and economic disputes with China would drive global markets south. Strong dollar policies may have led some investors to look outside the USD for returns and the opportunity of a weak Euro offered promising growth prospects in the short to medium term.

Looking Ahead:

- Looking at the two recent spikes in credit investment, we can see that these are unsurprisingly fueled by economic drawdowns and uncertainty. As all eyes turn to the rise of European self-determinism amidst the present conflict, there may be significant economic changes, and therefore opportunities in the credit investment space.

- As we look further ahead, it’s important to note that significant events can often ripple forwards, and any debt fallouts from the present instability may be revisited several times in the future as we saw in the example of 2014’s debt crisis. These risks and opportunities may raise their heads once again in the not-too-distant future.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…