Comparing Public and Private Market Performance: Does Geography Matter?

Comparing Public and Private Market Performance: Does Geography Matter?

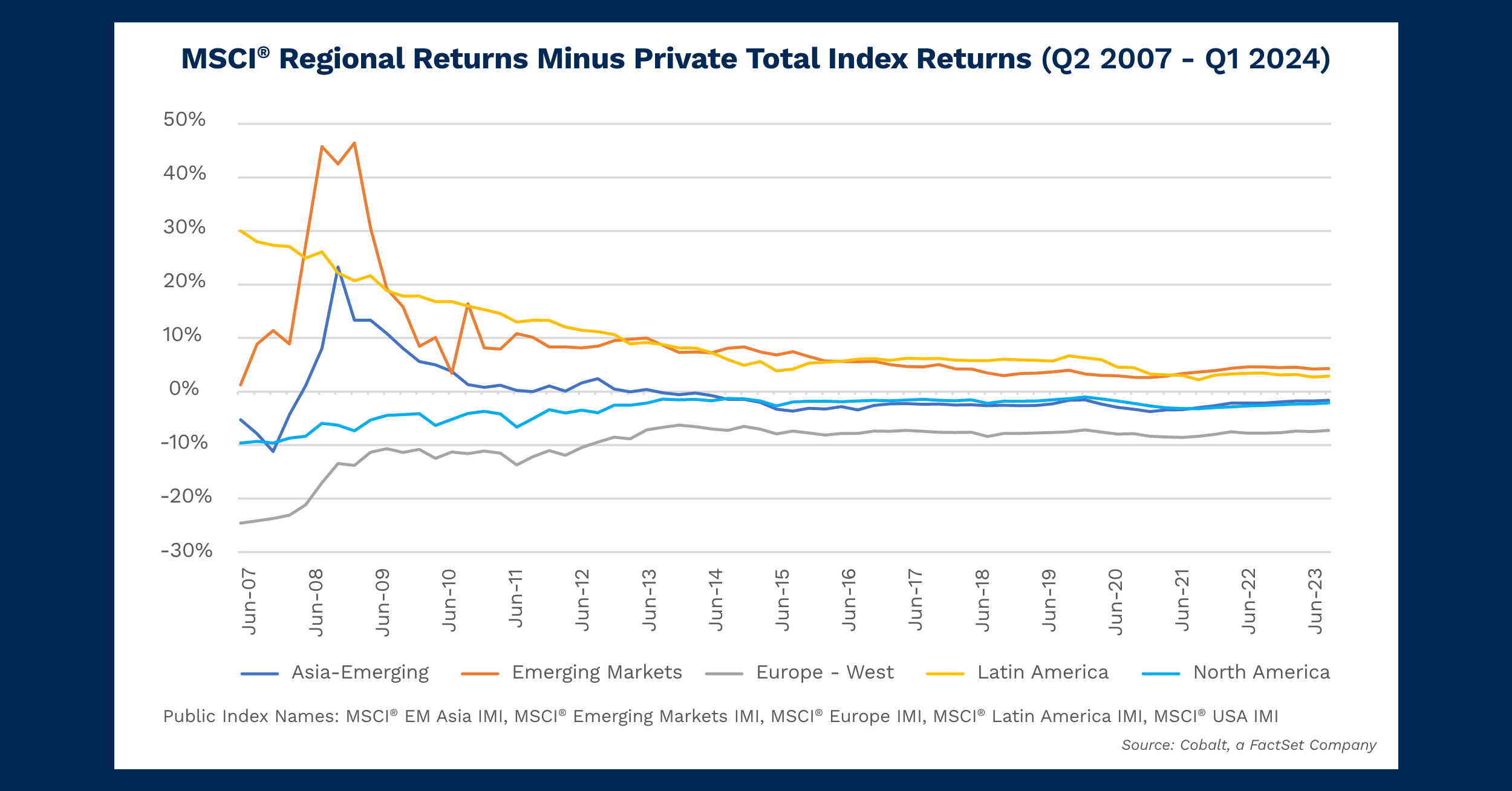

We’ve often analyzed various index returns in the public and private spheres over the years. For today’s analysis, we have augmented our approach to visualize the role of geographies in the variance between public and private market performance.

Given the robust data available, we selected Asia-Emerging, Emerging Markets, Europe-West, Latin America, and North America from the MSCI regional indexes on our platform. The analysis timeframe starts in 2007 so that you can also see the variance of returns after the Great Financial Crisis. Overall, there are several trends to examine.

Key Takeaways

All markets have ultimately trended toward the 0% variance line because of the cumulative effect of the performance numbers over time. The high variance in early years of our 2007 – 2024 sample period reflects a fair amount of noise in the data. However, as the data in our analysis reflects total returns over time, the equilibrium values in the later years are more accurate compared to the initial chart noise.

For 2024:

- The positive indexes are Latin America and Emerging Markets with a delta of around 3% and 4%, respectively. That indicates a higher return for the public market compared to the private market. This is likely due to a high loss ratio, and low internal rates of return among those private markets during our sample time period, buoying otherwise normal public market values.

- The negative index is Europe-West with a delta of around -7%, indicating a higher private than public market return. This is likely due to the stagnant public market returns of the region in the past 10 years combined with above average private market returns—especially a significant group that generated returns above 15%.

- The near-zero indexes are Asia-Emerging and North America with a delta of around -2%, indicating a slightly higher private than public market return. In both cases this is driven by high public and private market returns, with the disparity between the two likely driven from the illiquidity premium that private investment offers.

Looking Ahead

While this dataset covers total returns and therefore is not predictive of future public/private disparity in performance, it does show some overall trends on which geographies have tended to outperform in their public vs. private spheres.

Many of these trends are locked in: 4 of the 5 have always been positive or negative, with one, Asia-Emerging, having flipped between the two. It’s an interesting trend to follow as investment in private funds in China has likely overtaken public investment as the country’s public rate of return has slowed to other developed-market economy levels.

Furthermore, other select emerging markets may see a similar reversal, with their private markets beginning to outperform the public ones as their economies also stabilize and more robust pathways of private investment appear.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…