Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

In private equity, the large strategies of buyouts, venture capital, credit, and real estate naturally grab the headlines as the biggest players in the industry. But there is an important subset of strategies to explore: the fund of funds, co-investments, and secondaries that raise private capital to invest in the big fund strategies.

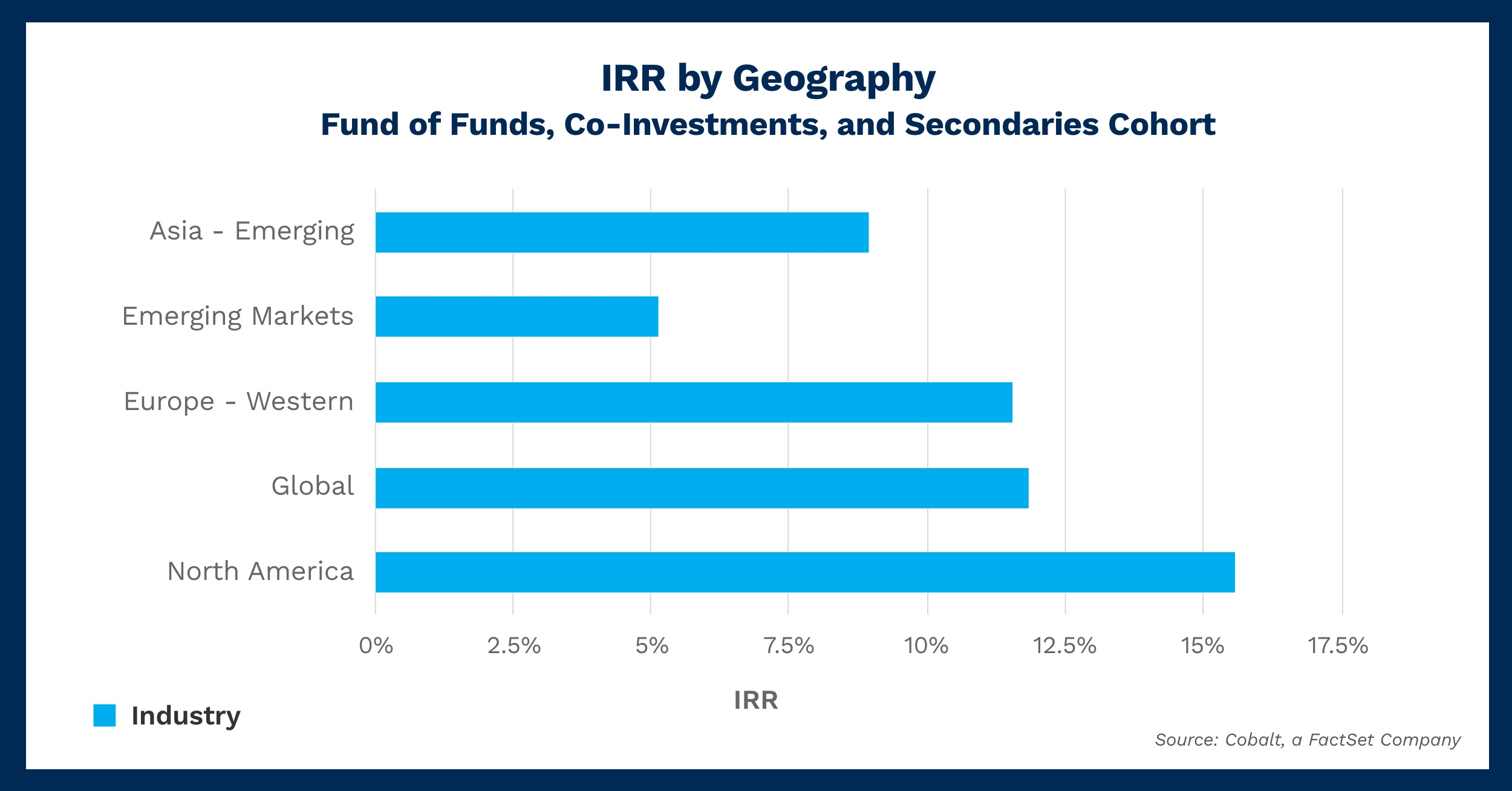

As those strategies make up a smaller percentage of the industry and our dataset, we’ve analyzed whether their returns mirror those of the total industry. We grouped them by geography and calculated respective IRRs.

Key Takeaways

The performance of this subset mirrors the performance of the overall market almost exactly, with a 12.6% IRR across private equity in our dataset and 12.5% for the subset. In addition to performing roughly in line with the market, the subset offers diversification opportunities to investors.

The geographies themselves also align with what we see more broadly, with North America, Western Europe and global markets performing the best. North America particularly stands out with an IRR of 15.6%. The robust alternatives market in North America creates ample opportunities for fund of funds, co-investments, and secondaries, all of which could continue to attract more investment in the future.

The emerging markets regions (including Asia – Emerging) lag the broader market, averaging 7.7% IRR across the three strategies compared to 9.41% across all private equity strategies. The disparity suggests that more nascent PE environments (as opposed to developed markets) produce less fruitful returns on fund of funds, co-investments, and secondaries.

Looking Ahead

Regarding the last takeaway, consider monitoring whether the performance of these strategies strengthens as the market matures and aligns more with the performance of developed markets. This would likely be the result of a large shift in the subset markets and thus may take over a decade to see it bear out.

On a shorter horizon, the new administration and Congress in the United States may play a large factor in shaping alternatives, including the subset we’ve discussed. While we don’t have any solid policy to examine yet, the combination of potential foreign investment, tariffs, and changes to corporate tax structures could be a boon for alternatives, which would strengthen the returns for fund of funds, co-investments, and secondaries.

Subscribe to our blog:

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…

Comparing Public and Private Market Performance: Does Geography Matter?

Comparing Public and Private Market Performance: Does Geography Matter? We’ve often analyzed various index returns in the public and private…

Changing Fortunes: Tracking 20 Years of Returns Across Credit and Venture Capital

Changing Fortunes: Tracking 20 Years of Returns Across Credit and Venture Capital Last month, the Federal Reserve announced its first…