Cobalt Chart of the Month: October 2020

Cobalt Market Data / Chart of the Month

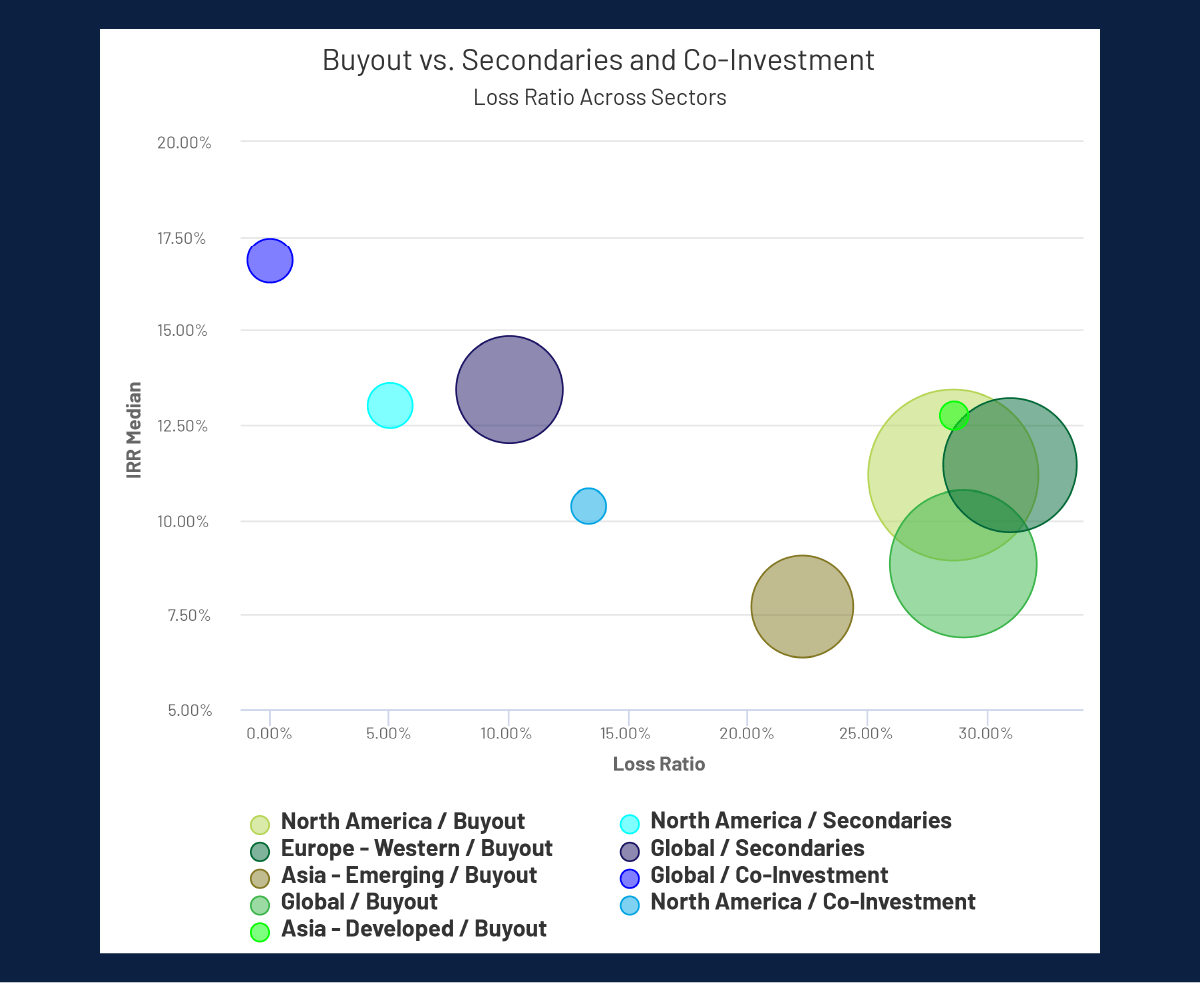

While buyout has been one of the most popular sectors in private equity over the past 10 years, often attracting huge sums of capital, its median return does not provide as strong of a benefit when compared to its loss ratio. Follow-on strategies such as Co-Investment and Secondaries, while far less popular markets appear to show a greater median return for a lower average loss ratio.

Buyout vs. Secondaries and Co-Investment: Loss Ratio Across Sectors

Key Takeaways

- Buyout appears to hold a respectable return profile that is consistent across various regions. The three largest regions (NA, EUW, and Global) attract more than $500 billion between them while holding a median IRR roughly in the 8-12% range. At the same time, these regions’ buyout investments have generated a roughly 30% loss ratio meaning that a large portion of these investments will not return the invested capital.

- By comparison, the follow-on investments in Global and NA have amassed less than $100 billion. Despite far less popularity, even the worst performing member (NA-Co-Investment) has the same median IRR as the buyout average (~10%) with less than half the loss ratio. The Global secondaries group boasts an even higher median IRR, for around one third the loss ratio. As such, far fewer Co-investment and Secondary groups exhibit unprofitable returns than buyout while those that do succeed also exhibit higher returns.

Looking Ahead:

- Going forward, as more winning companies and funds are found, will these regions continue to dominate this clearly profitable marketplace, or will more developing regions be able to capture these gains as well?

- Will such follow-on strategies continue to be profitable, or will increased competition lead to riskier and lower performing investments?

- Could their performance be overshadowed by the continued trust in more conventional investment areas such as Buyout?

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…