Chart of the Month: June 2023

The Bridesmaid: Secondary Liquidity Investment Trends from 1999-2022

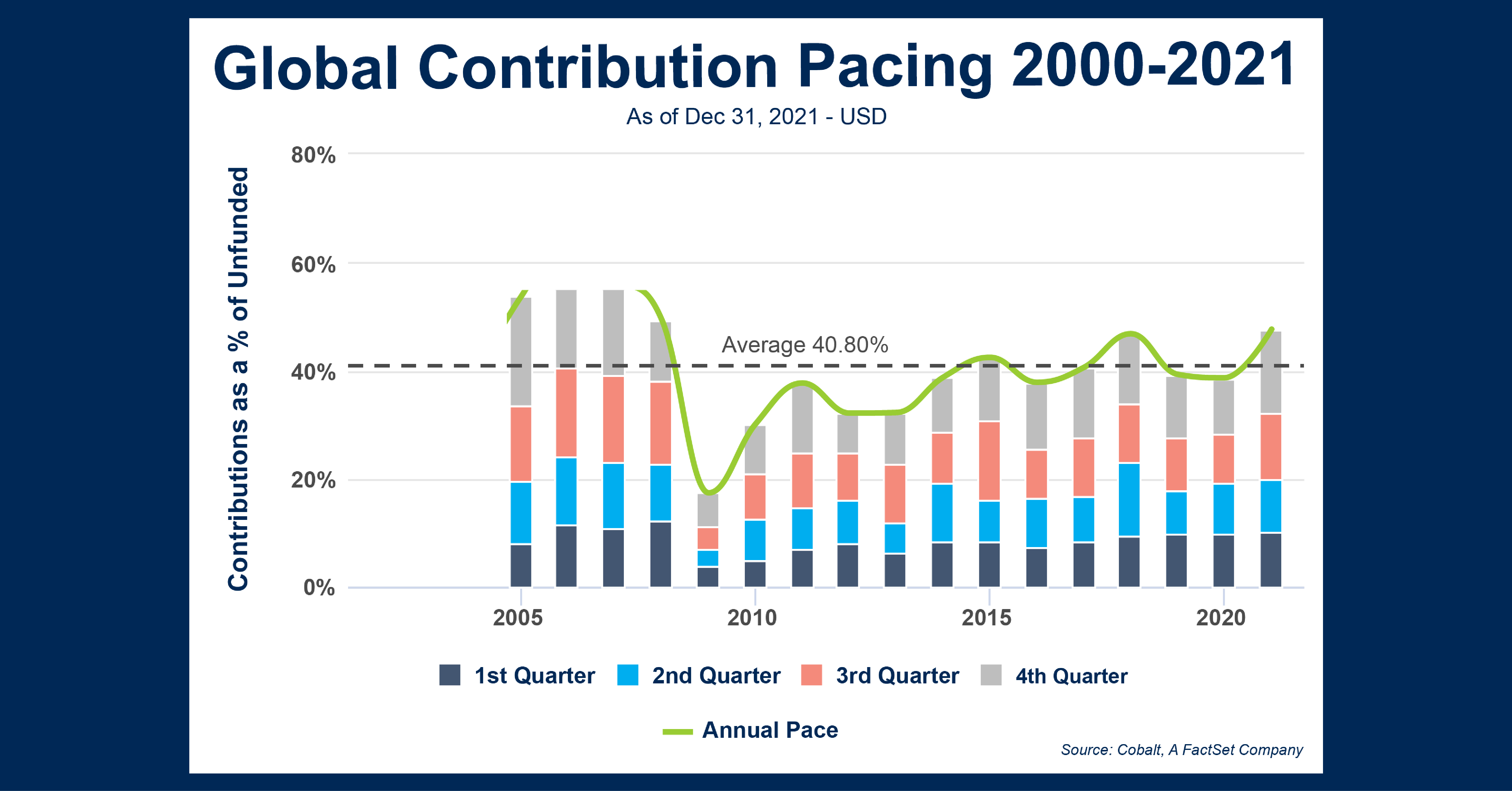

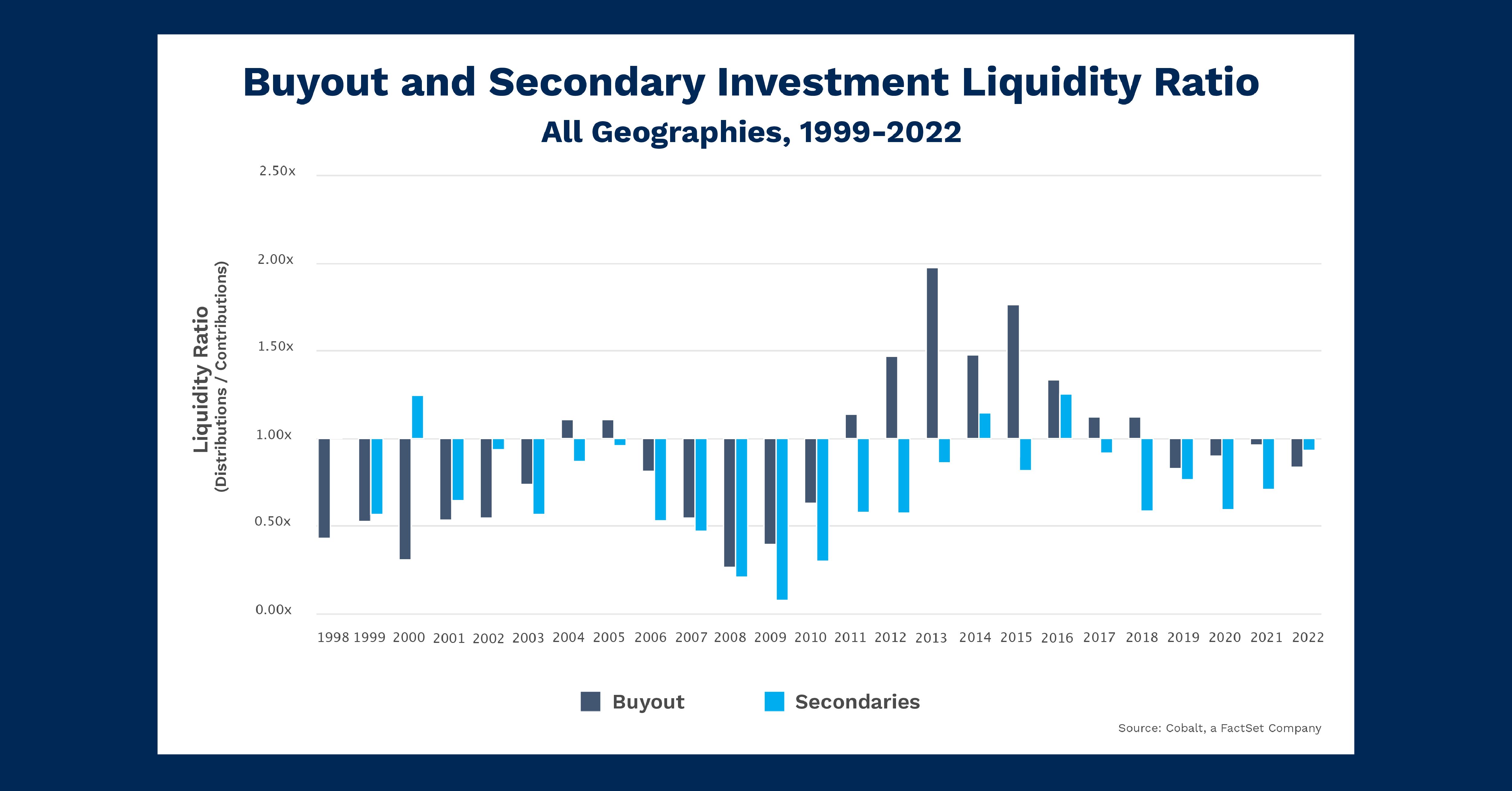

Wedding season is in full swing, and as many are searching for cheap suits and flights, we’ve looked at an always–invested–in but–never–obsessed over style: Secondaries. To gauge investor interest and cyclicality, we used Cobalt market data to compile the distributions and contributions in the secondary fund universe against buyout funds (which we feel is representative of the overall private market trend). This analysis gives a size–agnostic sense of how investors pay in, and how they are paid out for their choices.

Key Takeaways

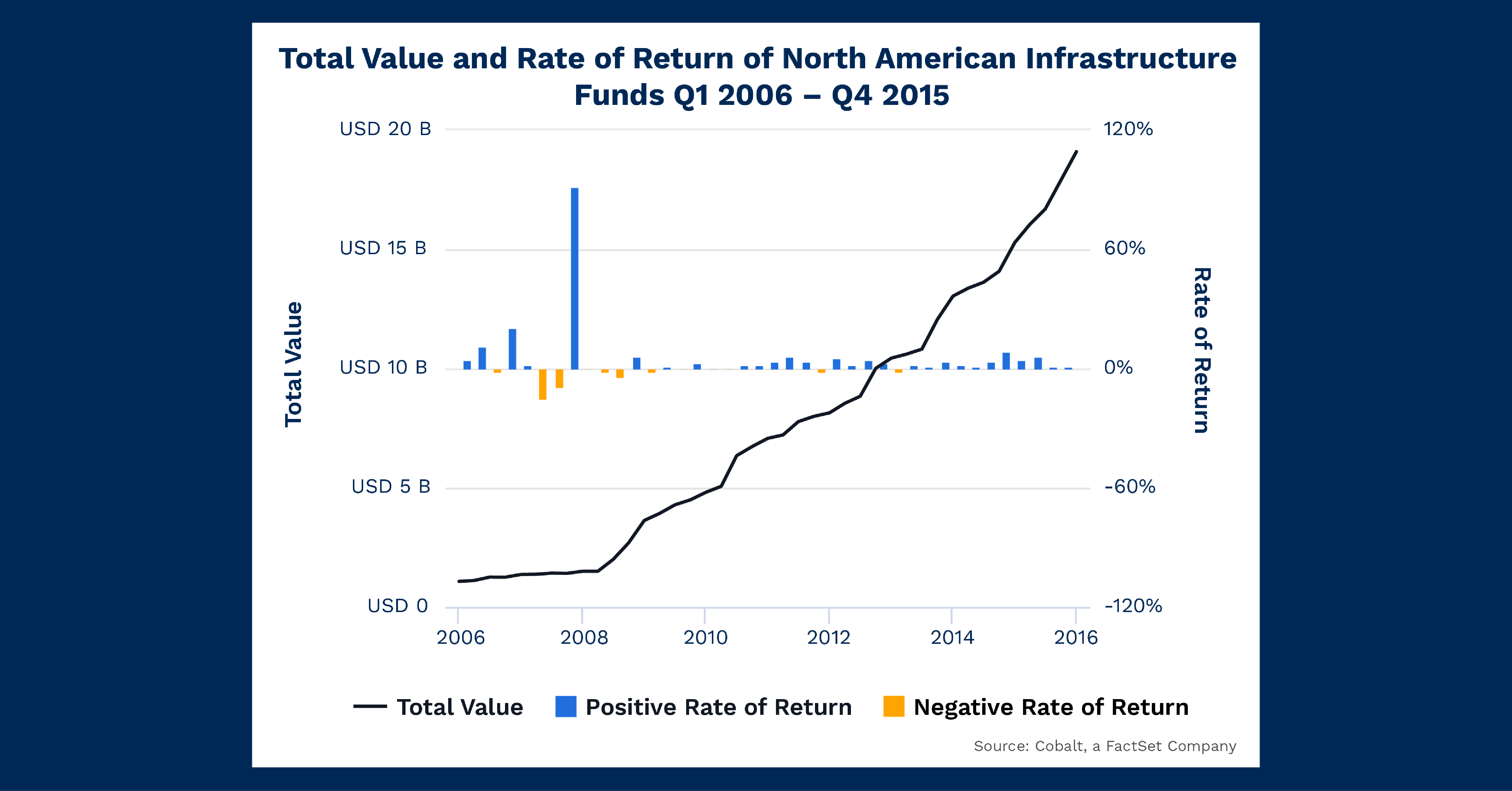

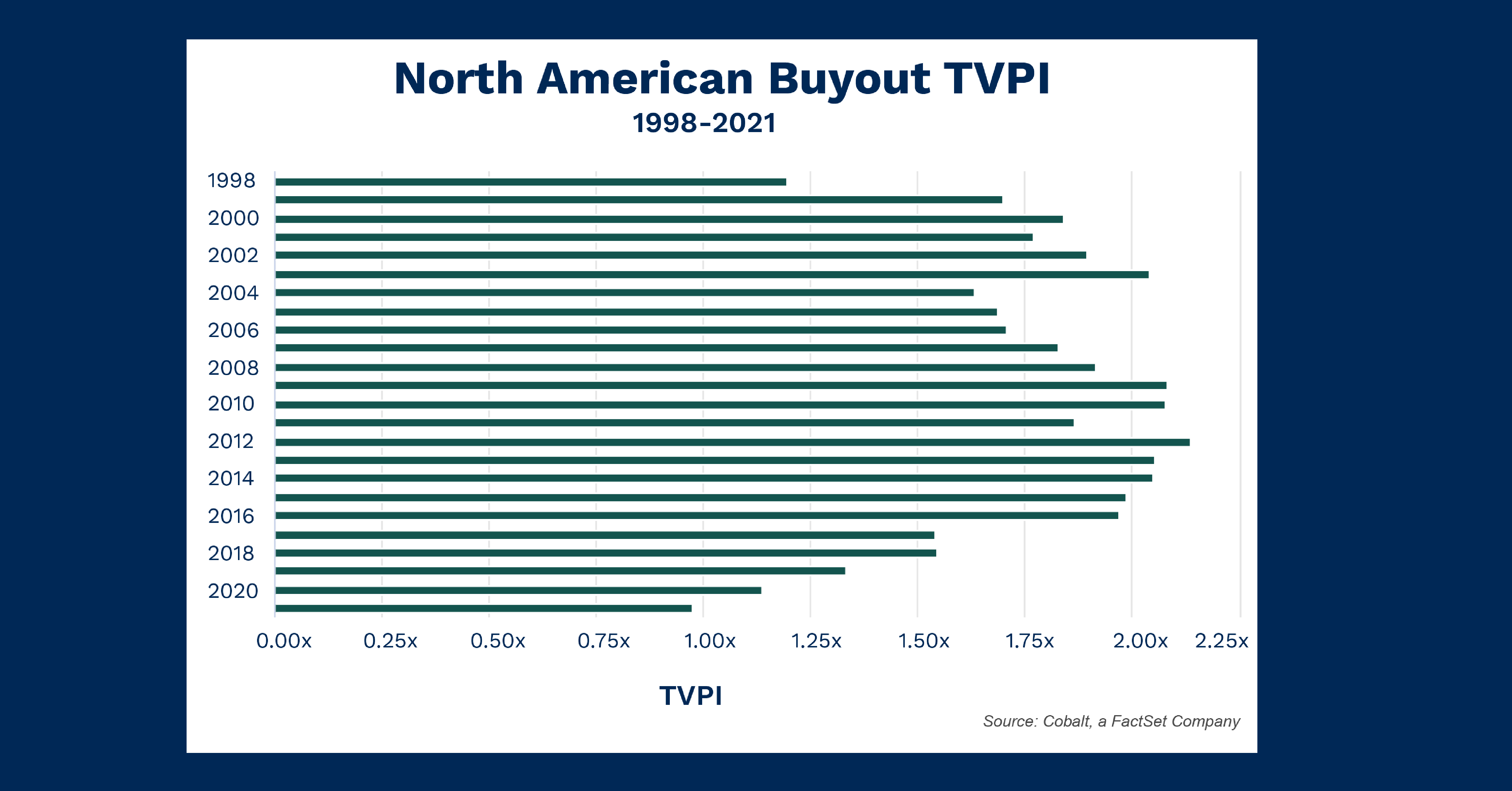

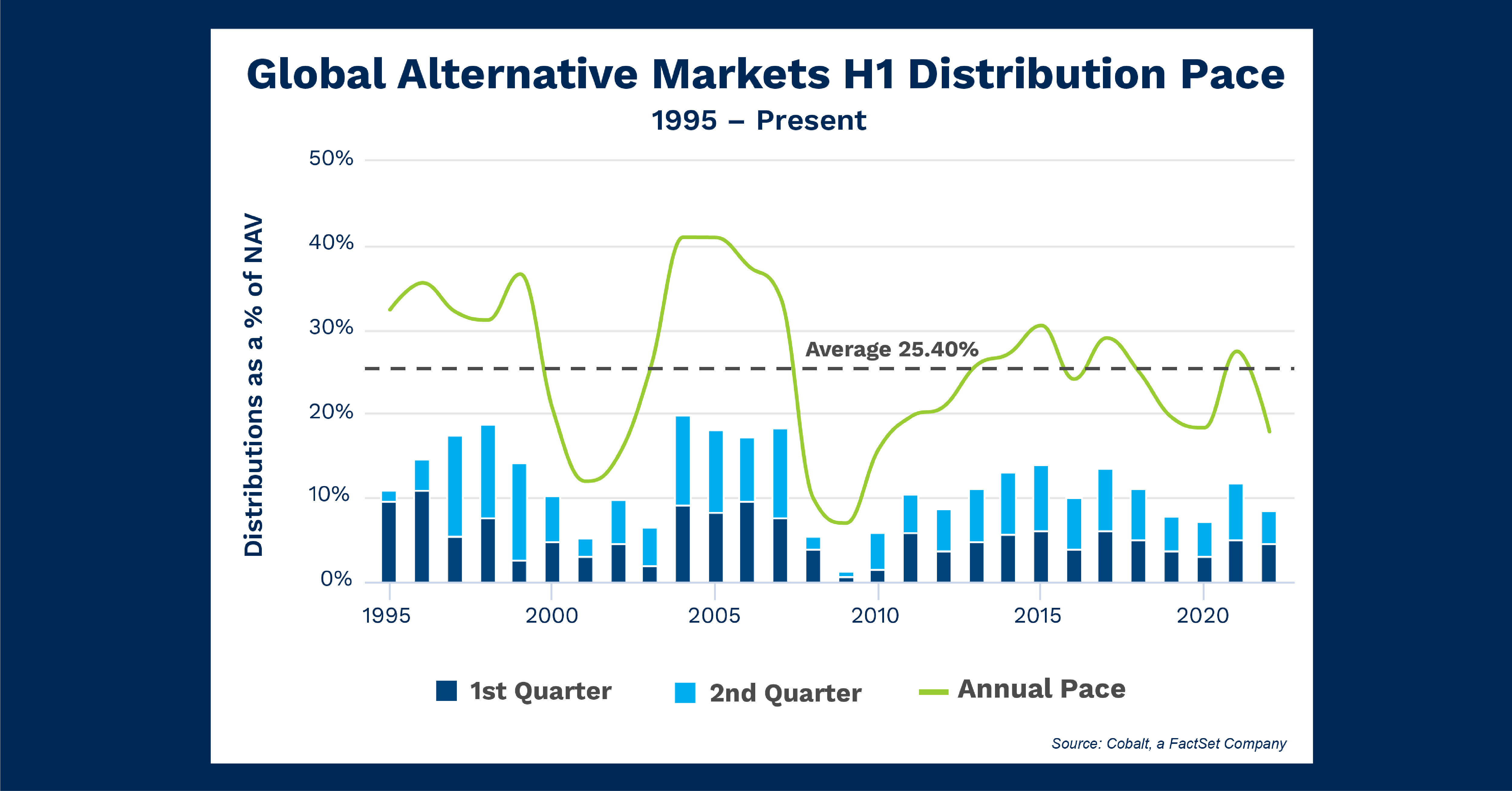

To start, let’s dive into buyout fund liquidity over time. This is representative of the general liquidity cycle of private markets over the past 20 years. Most mainstream strategies (excluding Secondaries, Infrastructure, and Natural Resources) follow the pattern in the chart above. The overall private market investment cycle is characterized by higher contributions during and following recessionary events (2000-2003, 2007-2010) and higher distributions immediately after the recovery (2004-2005, 2011-2018). This implies a cyclical approach to private market investments. Investor interest is counter-cyclical, with investment surges resulting in payoff surges about five years later when the funds begin distributing.

So, why and how do secondary funds break the overall private market trend? As seen in the chart, Secondaries roughly follow the same pattern of investing during economic downturns (with more distributions coming out of these downturns), but the scale of distributions is heavily muted compared to the benchmark.

One explanation for this is the scope of secondary investing trending upwards, with NAVs increasing since 2006. Total secondary fundraising in the 2000s was only $85B, compared to $335B in the 2010s. As a result, the significance of $2B excess contributions is much greater in 2008 when total contributions and distributions are around $3B. Conversely, in 2013 $2B excess distributions are compared to more than $12B total. The result is the diminution of the liquidity ratios following the 2008 recession seen in the chart above.

Looking Ahead

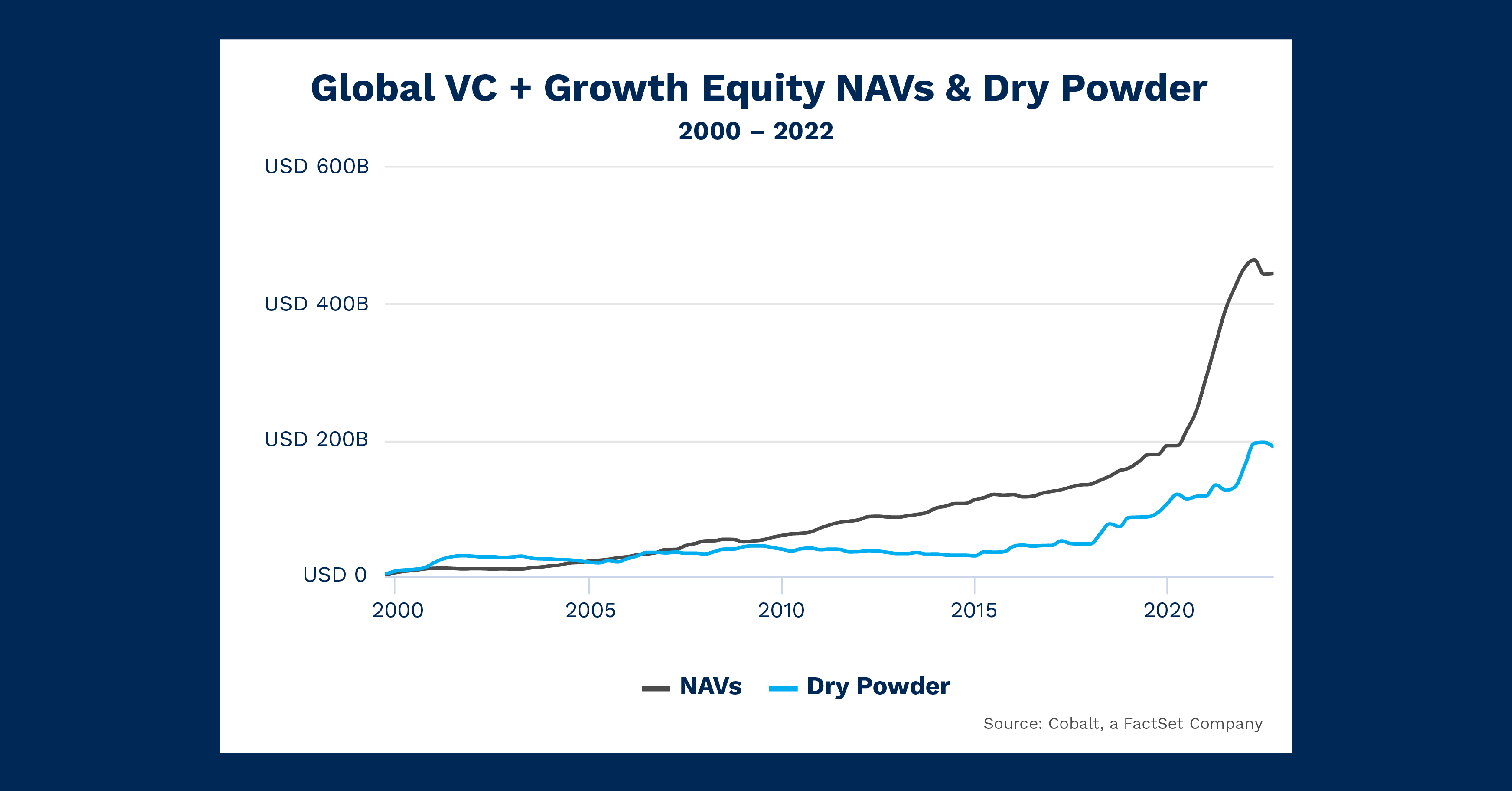

It’s clear that secondary funds have been a popular investment strategy amidst the Covid-era drawdown. This is in line with the broader market, but combined with rising NAVs proportionate to contributions we could anticipate another disruption of the cyclical pop as distributions will be paid out in the coming years. This will likely be overshadowed by the volume of investment, yielding a “surprisingly” subdued liquidity ratio.

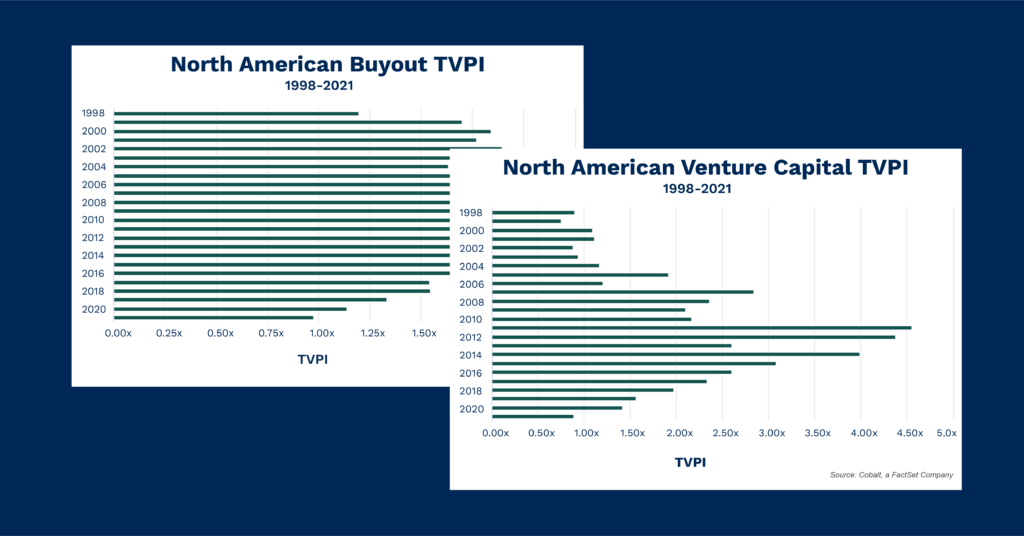

However, apart from appearances, this does not reflect the investment style performance and the ability to generate returns, as the increasing popularity is reflective of Secondary’s relatively similar performance to the rest of the private markets.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…