Chart of the Month: August 2022

From Small Things: North American Venture Capital Compared to the Russell 3000

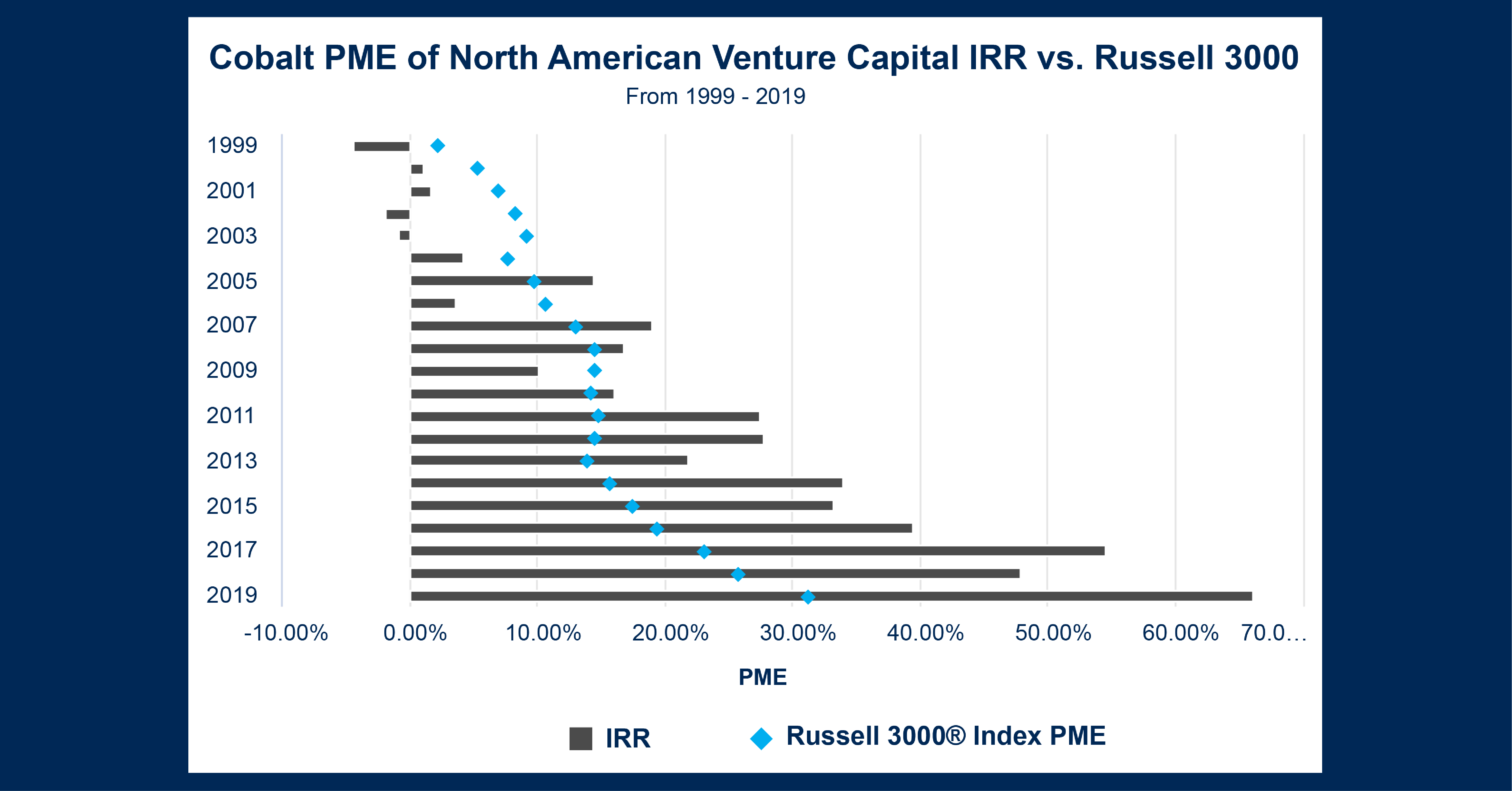

Last September, we did a study examining buyouts vs. the Russell 3000 in the context of the economic volatility of 2020. This month, we’re revisiting this idea applied to a different section of the private markets: venture capital. Given that the present economic shakeup may have significant effects on the tech leaders of the 2010s, we thought it prescient to look at how the future innovators have been performing compared to the public markets. Using Cobalt’s in-house PME calculation, we compared the two indexes over the past 20 years to see what factors may inform performance.

Key Takeaways:

- Our last chart emphasized how buyouts could often take advantage of weaknesses in the public markets. By contrast, we see the unique issues suffered by the venture capital market—the market was heavily impacted by recessionary events, even compared to their public counterparts. While public markets do stall out during recessionary events, there appears to be a sharp decline in venture performance for funds raised around these periods, likely due to a pullback in investments and demand leaving many of these fledgling companies out to hang.

- In the second half of the chart, we see another trend at work. While the dot-com bubble clearly impaired the venture capital market for a long time, venture quickly rebounded from the global financial crisis and accelerated far quicker than the public markets. While the “everything rally” of the last 10 years raised all ships, venture capital seems to have been especially productive during this time. This is likely due to its positioning allowing for far greater growth than more established markets.

Looking Ahead:

- Having flirted with two recessions in the past three years, there is much speculation on the direction of financial markets. The 2020 recession proved remarkably short-lived, and the present turmoil continues to teeter on the fringes. Venture capital is not at the heart of the drawdown so we can extrapolate that while the venture market may suffer acute setbacks from investor jitters and denominator effects, overall interest will remain strong and could likely bounce back faster than public markets.

- Given that many of the largest drawdowns in the latest downturn have been in the big tech sector, there may be even greater opportunity for innovative venture-backed companies to rebound and feast on the lost market confidence in the former innovators of Big Tech.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…