Private Market Firms: Cobalt & FactSet Solutions

Taking Next-Level Portfolio Monitoring Technology to Private Market Firms Globally

Now, more than ever, private market firms have a growing need for a complete workflow solution that connects differentiated data with sophisticated tracking and portfolio reporting.

Cobalt’s Portfolio Monitoring platform provides private market firms with intuitive technology for collecting, analyzing, and reporting on fund and portfolio company data. FactSet is a global provider of integrated financial information, analytical applications, and industry-leading service.

Together, Cobalt and Factset will deliver an end-to-end solution for private market firms to simplify their investment processes. The features and benefits of Cobalt, a FactSet company, include:

- Advanced data & cash flow analytics

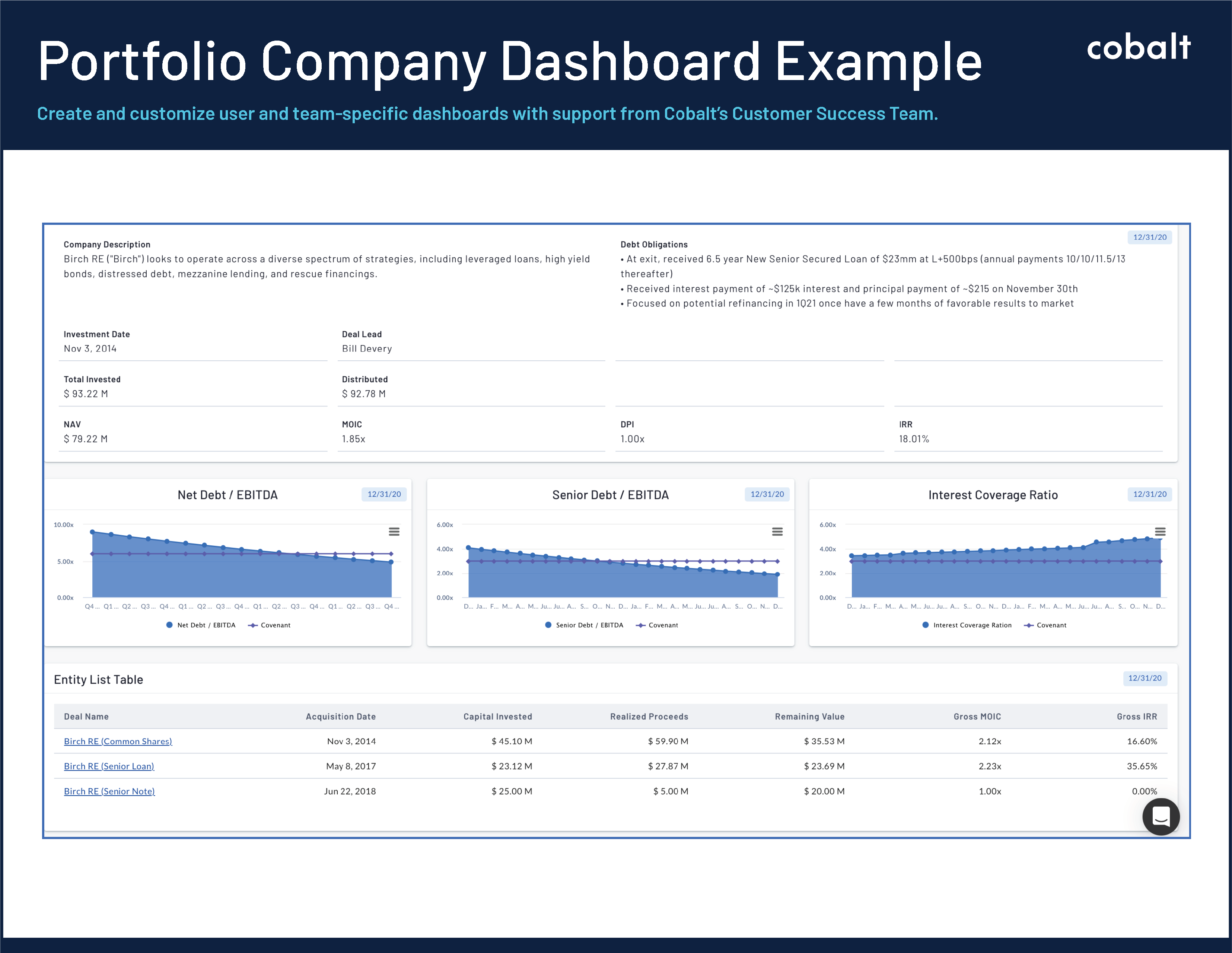

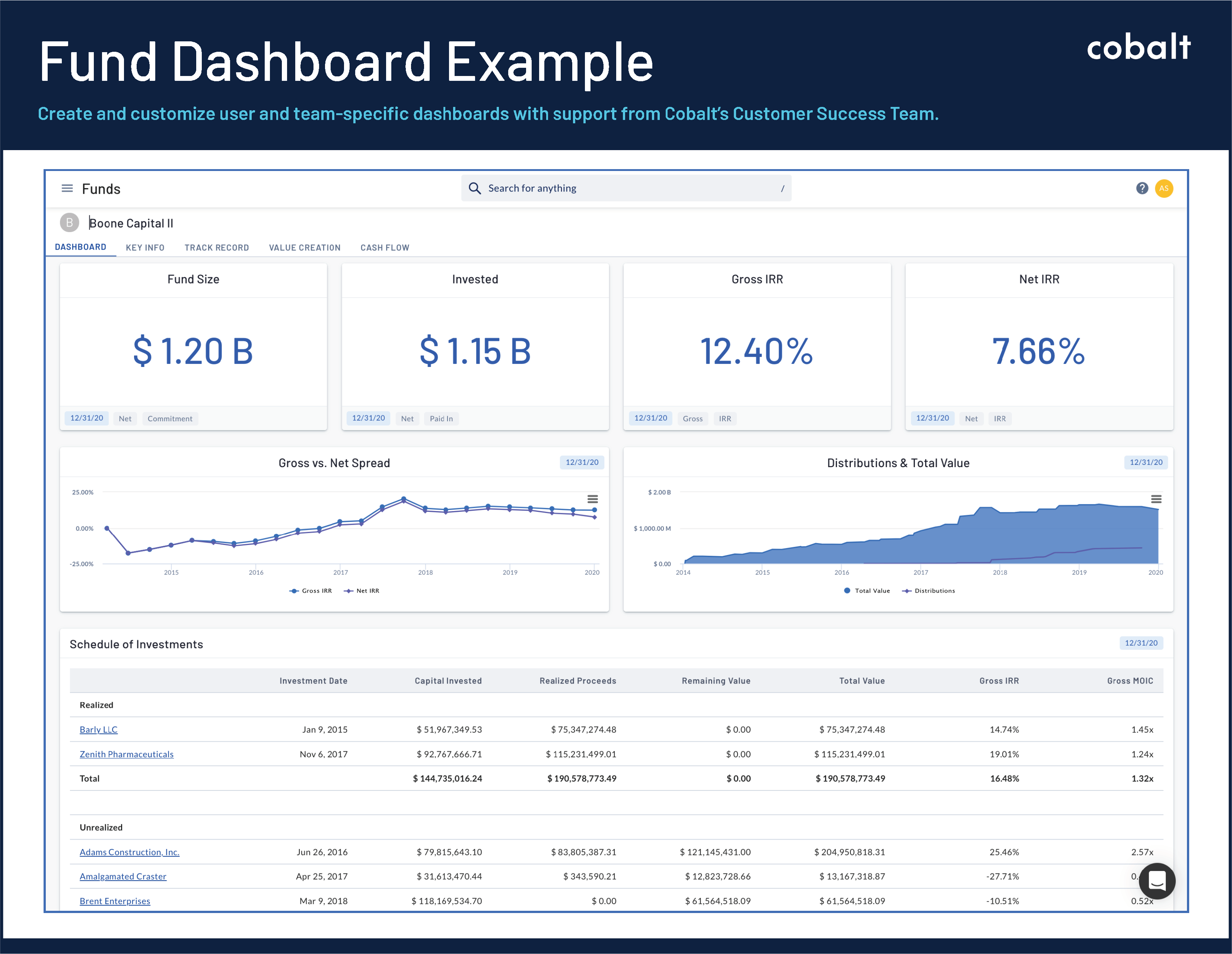

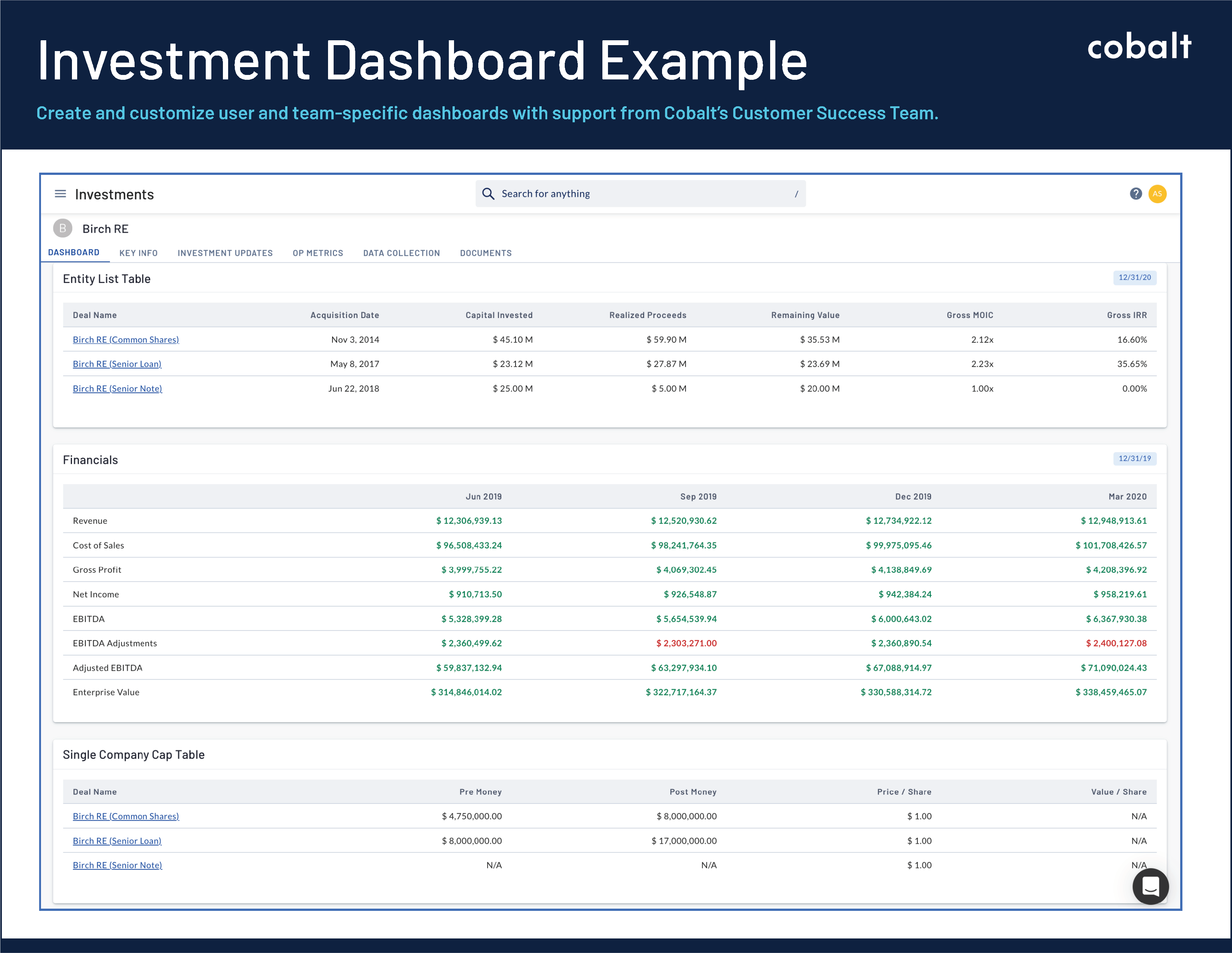

- Personalized fund and portfolio dashboards

- Flexible, recurring performance reporting

- Top-tier data sets & investor intelligence

- Excel plug-in & APIs

- Dedicated client support and consulting

Schedule a call below to learn about Cobalt + FactSet’s Private Market solutions:

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…