Chart of the Month: September 2023

Down and to the Right: Assessing Western Europe Alternatives by Investment Style

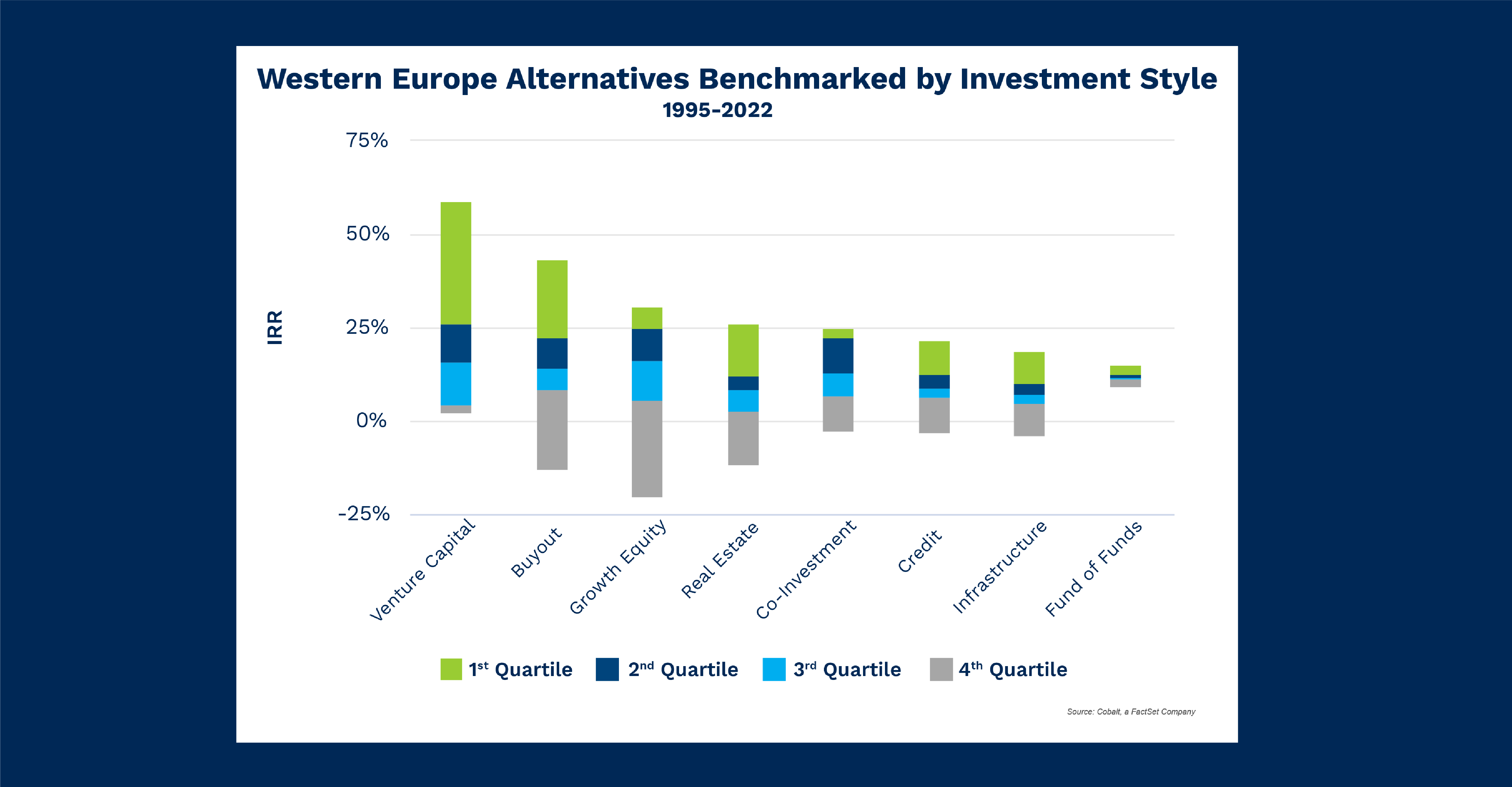

After a recent portfolio monitoring client win in Spain, we decided to review Western Europe for this month’s analysis on alternative fund performance. In the chart below, the Q4 benchmark for each investment style illustrates how a Limited Partner (LP) may assess their portfolio weightings in the region.

Key Takeaways

Unsurprisingly, venture capital and buyout funds have the highest first quartile returns. However, the roles are reversed on the downside: Venture capital remains completely above a 0% return, while buyout funds have more risk of not returning an investment. This highlights that ingrained trends often appear in the aggregate, but focusing in on a specific region may expose deviations from the norm.

The largest investment styles in the alternative fund space (venture and buyout) offer the highest returns, but they are joined by growth equity and real estate, two other styles that have the highest upper fences of the benchmark. It’s important to note that co-investments are just behind real estate in this regard, having a higher first quartile floor.

The investment styles with lower fence bounds (credit, infrastructure, fund-of-funds) do offer the benefit of tighter overall benchmarks, meaning an LP may have a better idea of their overall return when investing in these styles. Fund-of-funds exemplifies this best, with only a 6% difference between the upper and lower-fence of the benchmark.

Looking Ahead

It will be important to keep in mind U.K.’s continued struggles with inflation when observing the next trends in Western Europe. Most other major economies have reduced or muted the effects of inflation at this point, while the U.K. may still be mired in a macro climate that’s less friendly to alternative returns.

With a more volatile environment, it will be interesting to see if the unexpected observations in the venture capital and buyout lower quartile returns revert back to the average benchmark moving forward.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…