Chart of the Month: May 2022

The Rolling Stone Gathers Momentum: Resilience and Investor Interest in Eastern European Markets

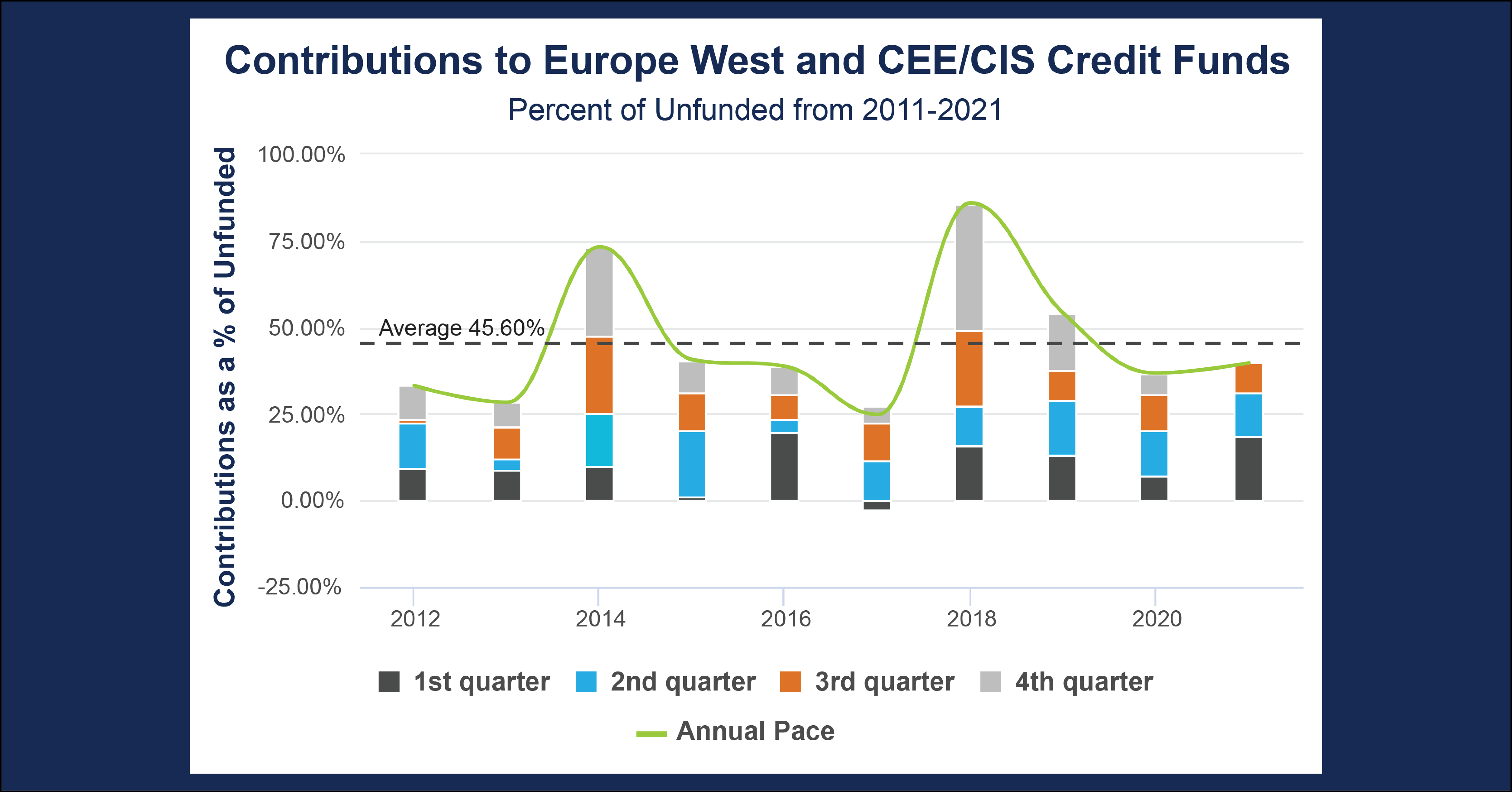

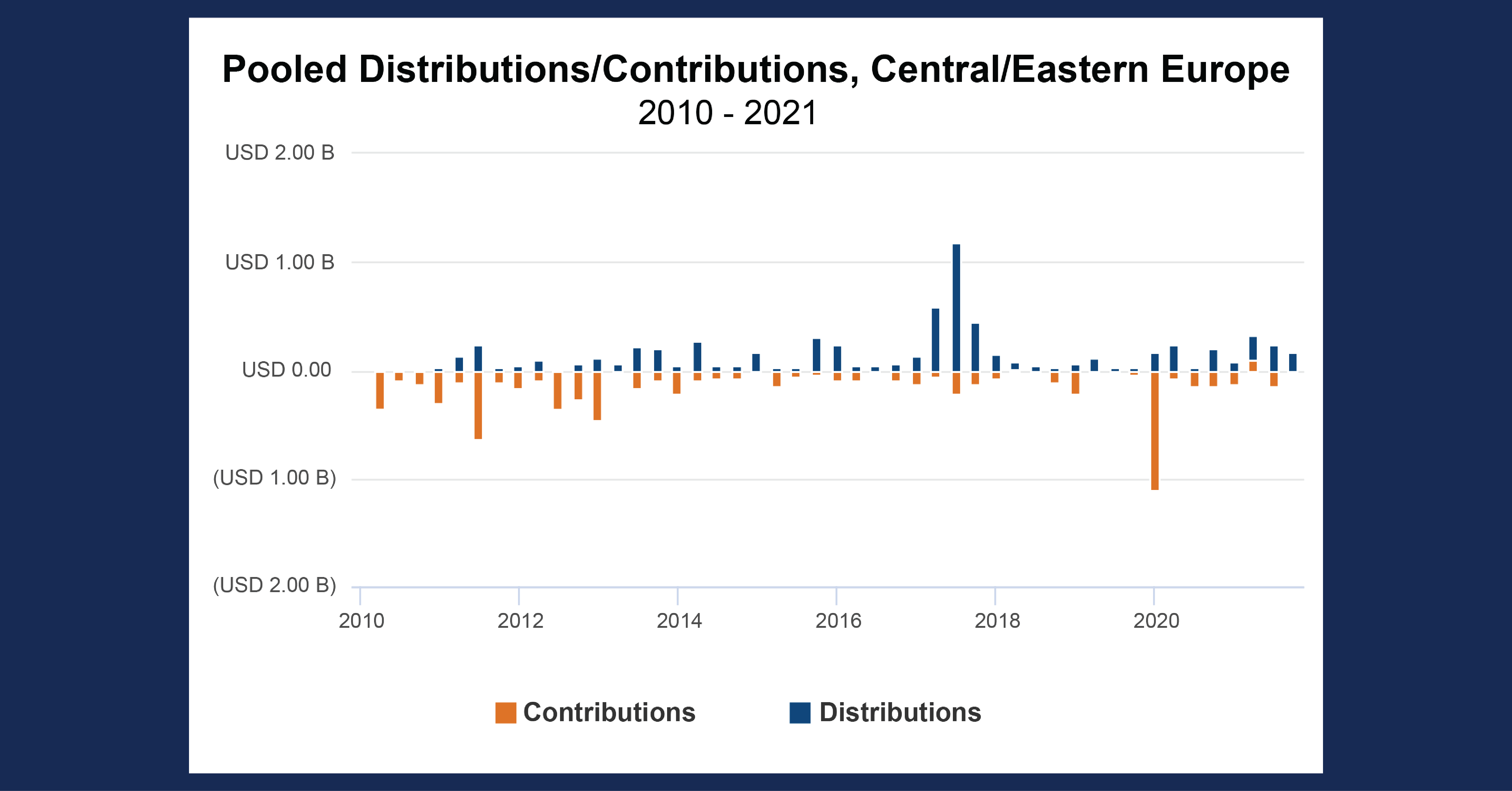

Eastern Europe has come to the forefront of current events this year with the conflict in Ukraine. Continuing our exploration from last month , we wanted to examine the private equity landscape of the region, given that it is often underexplored compared to the Western European markets. With that in mind, we used the Cobalt Market Data to analyze the total cash flows from 2010-2021 in Central and Eastern Europe.

Key Takeaways:

- At the start of the decade, distributions were few and far between. This could largely have been due to the recession immediately preceding the 2010’s, as distributions across the board were suppressed throughout the market.

- Conversely, contributions were still being made at the start of the decade, and the distributions finally did follow. Starting in 2015 and peaking at the end of 2017, the region accounted for over $3.2 billion in distributions in the middle of the decade.

- These cash flows happened despite the Crimean conflict in 2014, as well as debt crises in the area, and the announcement of the Fed Tapering plan taking place in the same year. This may point to investments, at least in the private markets, proving to be resilient in the area despite surrounding uncertainty.

Looking Ahead:

- Given the current unfolding situation, it would be foolish to say with confidence where the market is headed as things change from day to day. That being said, with Russia Ukraine being some of the of the largest economies in the region, the negative effects on the greater economy may be felt in the private markets.

- After a brief period of lighter investment, the region did see an influx at the end of 2019. Based on the past trend from earlier in the decade, we may see a similar string of distributions 3-5 years later under normal circumstances. Time will tell if these will still be able to happen on schedule in the current climate.

Subscribe to our blog:

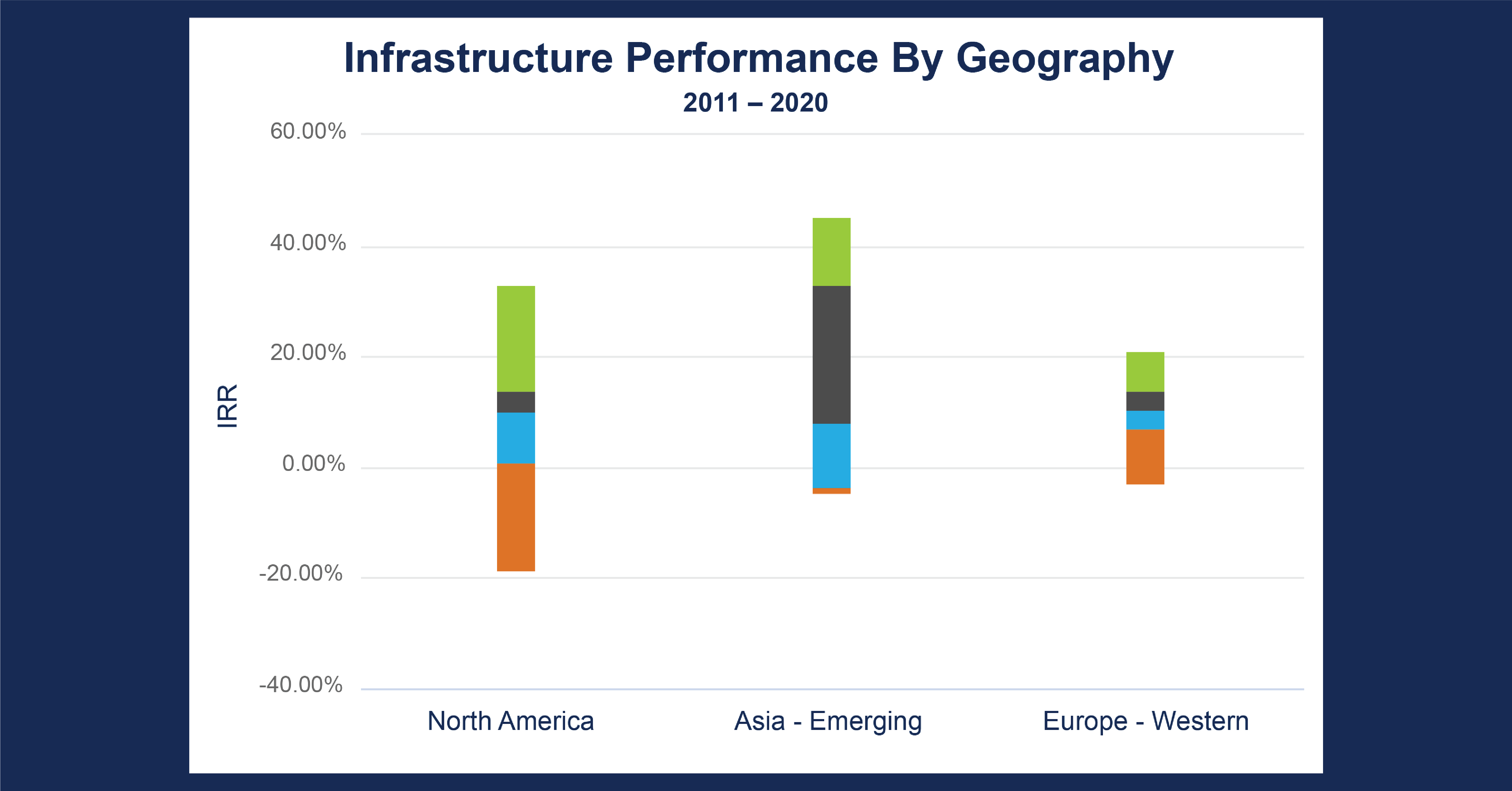

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

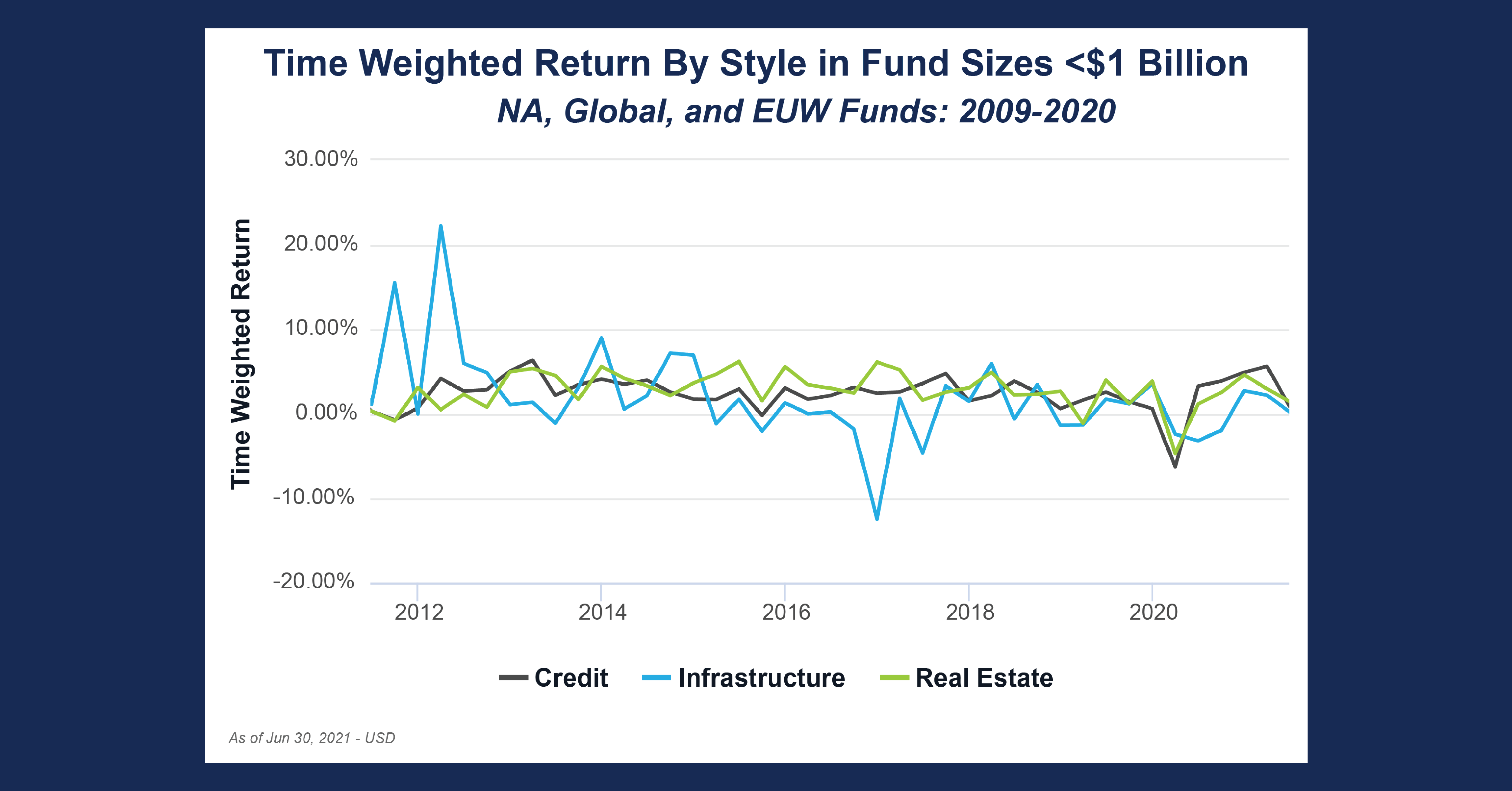

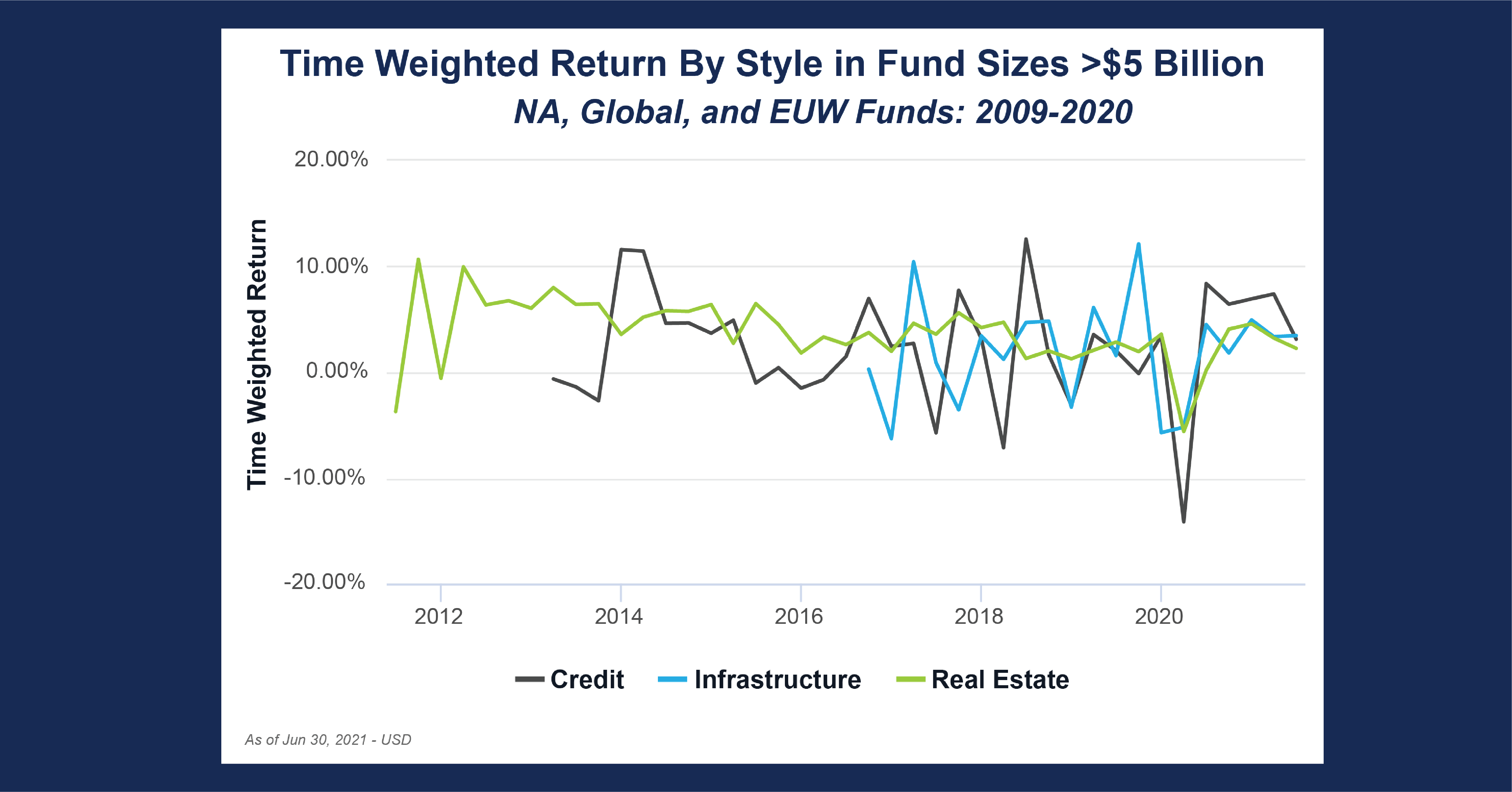

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…