Chart of the Month: June 2021

Ventured, Gained? How Geography Has Impacted Venture Capital Efforts

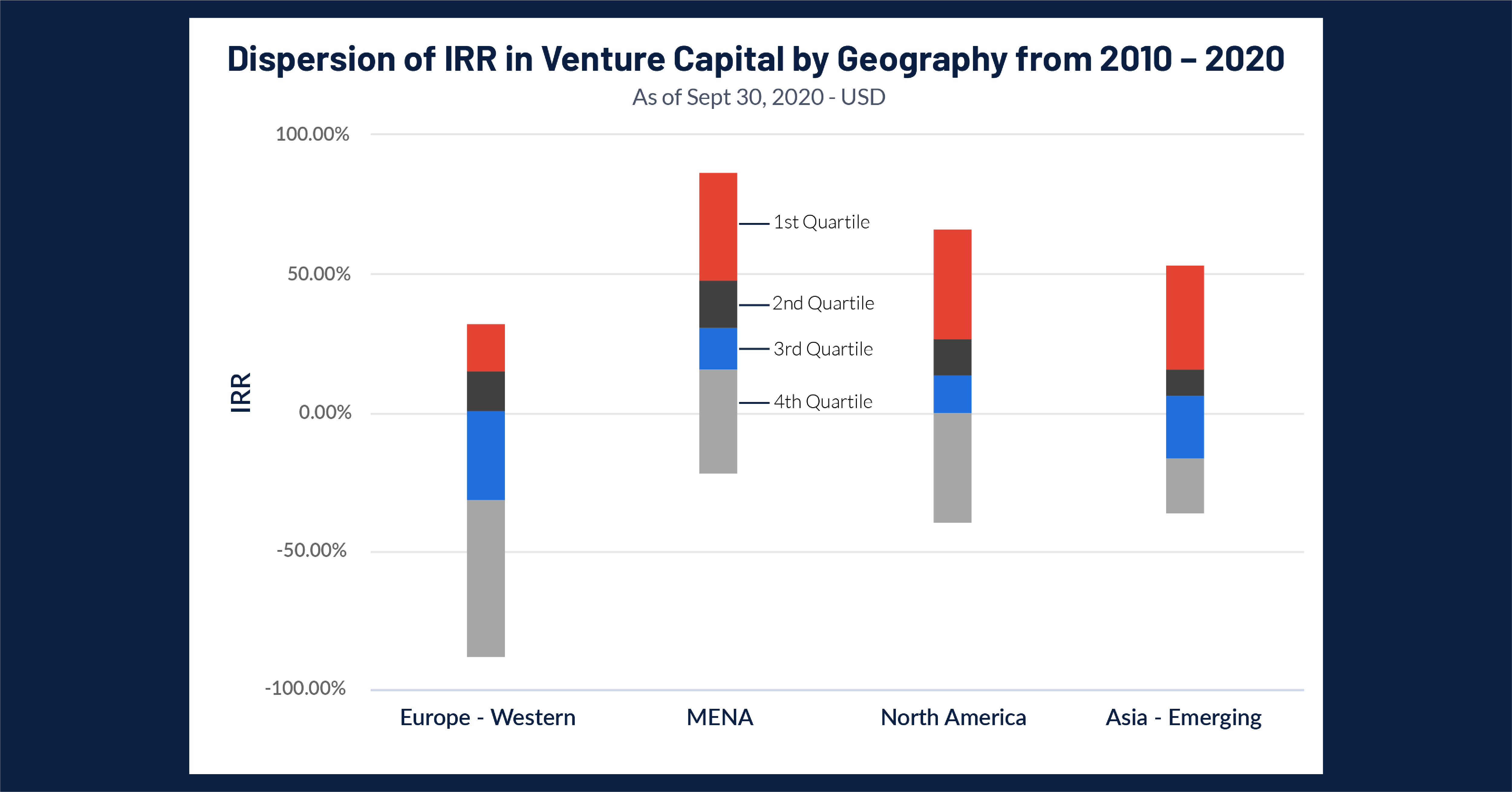

This month, we used Cobalt Market Data to take a step back to see how a fund’s geographic region shapes performance and specifically, how this impacts the performance of venture capital funds. As such, we examined the relationship between IRR dispersion and Geography in North America, Western Europe, Emerging Asia, and MENA since 2010.

Key Takeaways:

- As most would expect, North America boasts a fairly strong record of return here. The region demonstrates reasonably high variation in its first and fourth quartiles while the second and third quartiles are fairly tight. This indicates a “feast or famine” style, where the winners win big, and the losers lose just as big. Meanwhile, the safer funds earn a consistent, albeit conservative return. Undoubtedly North America is one of the hottest areas for venture investment and crowded American markets such as Silicon Valley have pushed some firms to pursue riskier investments to maintain upper-level returns and stay competitive.

- By contrast, Western Europe Venture Capital has had a far rougher time. Europe’s dispersion features the lowest upper and lower quartiles, and the lowest median return of approximately 0%. Their fourth quartile is also by far the lowest and widest of any region, giving a great deal of pause to any venture-curious investor. This come as little surprise to most as the European market (public and otherwise) has been stagnant for most of the past decade, only recently showing an uptick in interest amidst highly-priced American assets.

- Our most surprising discovery was the performance of the MENA (Middle East and North Africa) region. This area’s past decade has delivered stellar Venture Capital performance across the board with the highest top and bottom quartile, and fairly thin quartile dispersion, indicating higher floors on the funds that do lose. This may represent the region’s cross-section of favorable age demographics with fairly high available capital.

Looking Ahead

- Given the long-standing dominance (and high valuation) of American assets, there has long been predicted a shift away from them to other regions. While the entrepreneurial and investing infrastructures may not be fully prepared in all regions, and though the American regime seems far from over, this chart indicates that other areas are ready to accept venture capital investments in the near future.

- Despite lower historical performance in areas like Europe and Emerging Markets, there is clearly venture interest in those regions, and with the progressive crowding of American markets, these regions could see inflows and upswings in performance over the next decade.

- And what of letting winners ride? It would be very surprising to see interest die out in a region such as MENA now that it has proved to be receptive and profitable. This will encourage far more investor interest, further building venture networks in the region and producing dominant outcomes.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…

Key Takeaways:

Key Takeaways: