Preparing for 2021

Cobalt launches new website

2020 has been a big year for Cobalt: from major product enhancements to new critical partnerships, we’ve delivered on our commitment to bolstering our private capital GP clients’ experience on our platform.

We work diligently to meet our clients, quite literally, where they are, so they can take their firms and portfolios where they want. The result is improved performance, excellent reporting, and top-tier business intelligence to propel private capital firms well into the future.

As we head into 2021, a year that promises to hold even more good news from Cobalt, it was time for us to revisit our website. In a world where your online presence is often your first “port of call” for anyone you do business with, it was important that our own telegraphed the streamlined, intuitive experience our clients have on our platform.

So, tying in with the logo we launched earlier this year, today we launched our brand new website. In a nutshell, it provides a clearer picture of what you can expect to find in the Cobalt platform, the company we keep among integration partners, and the type of ideas, reflections, and conversations we are having daily across clients, partners and other industry leaders.

We hope you like it. As always, if you have any feedback or questions, don’t hesitate to reach out to us directly.

Subscribe to our blog:

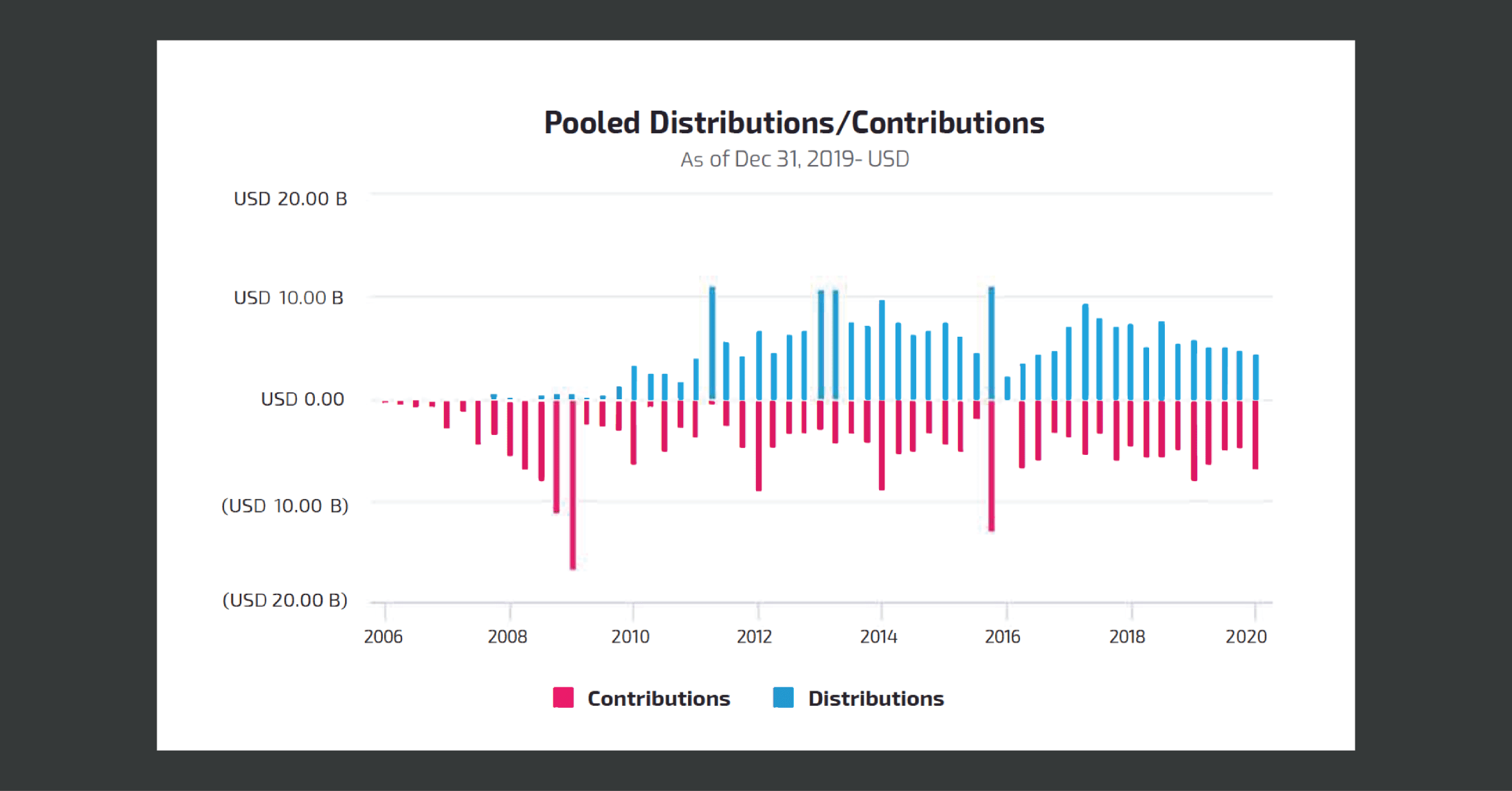

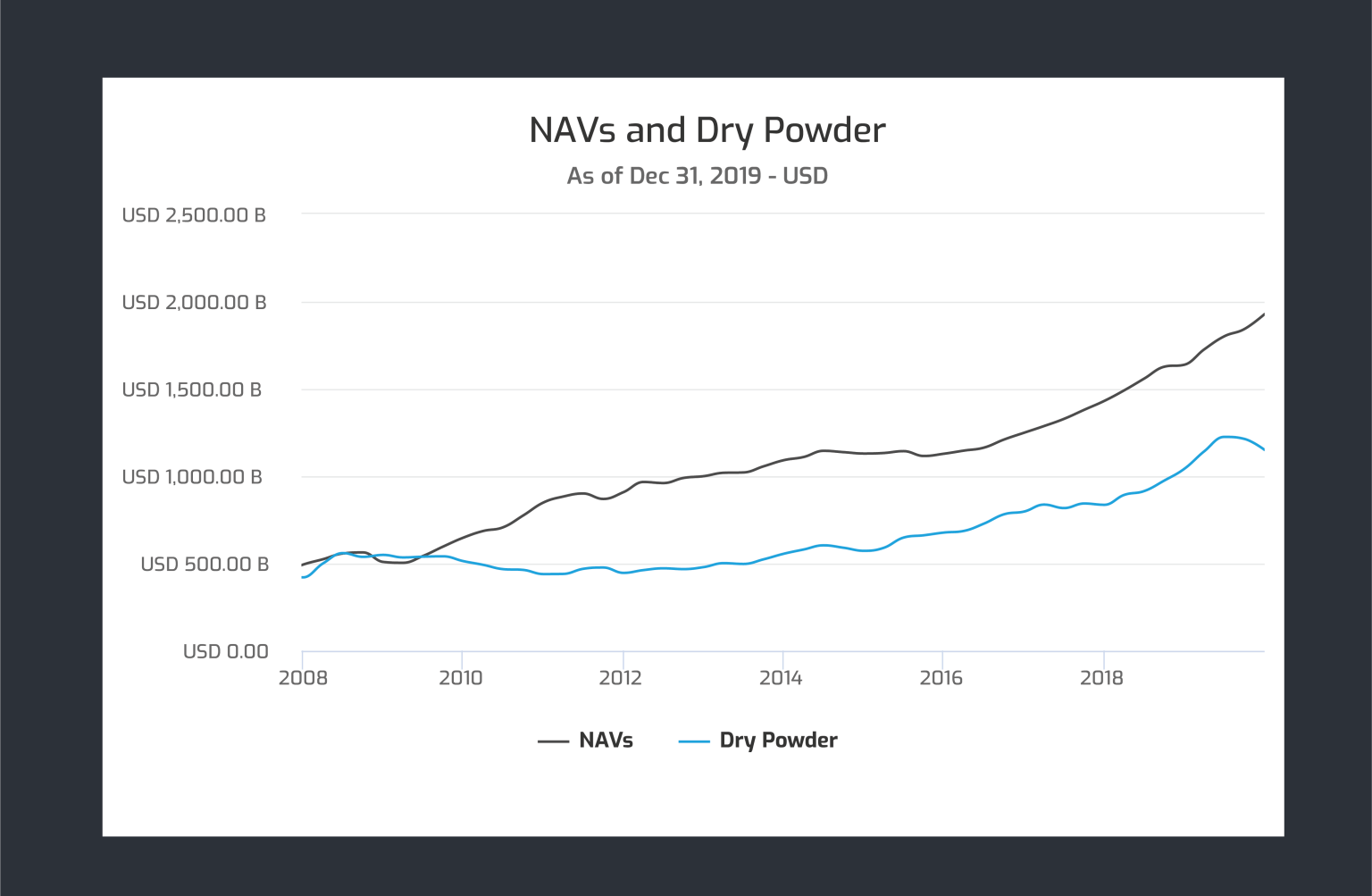

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

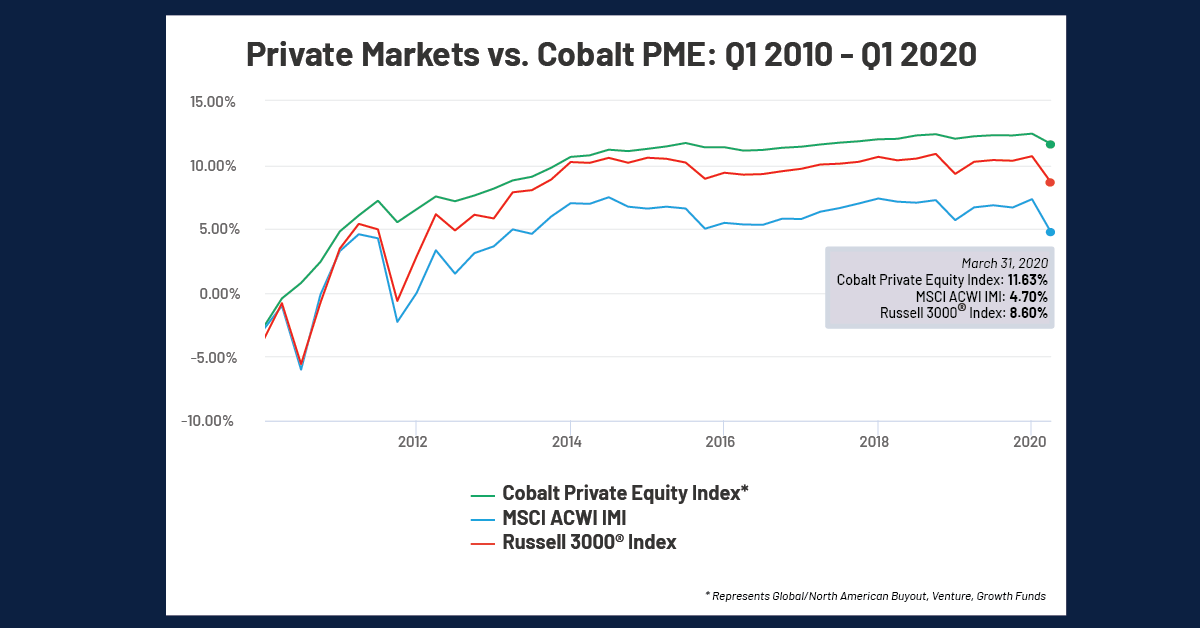

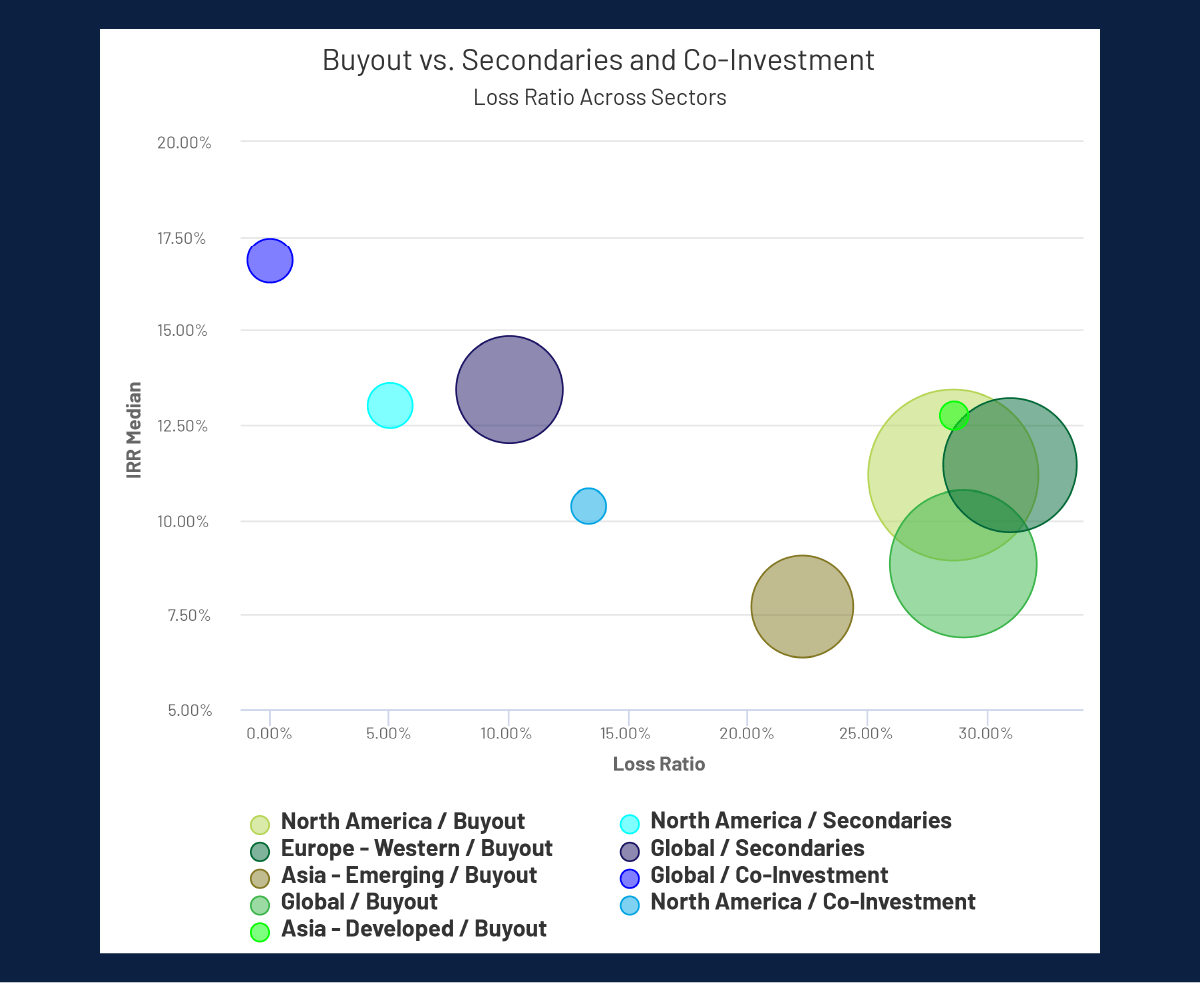

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…

Solutions you’ll want to consider will include these critical features, automated:

Solutions you’ll want to consider will include these critical features, automated: