Chart of the Month: July 2023

Q4 Crunch Time: Revisiting 2022 Returns at Year-end

Before we publish Q4 2022 benchmark in Cobalt Market Data, let’s revisit our February analysis of 2022 H1 distribution pacing by vintage year.

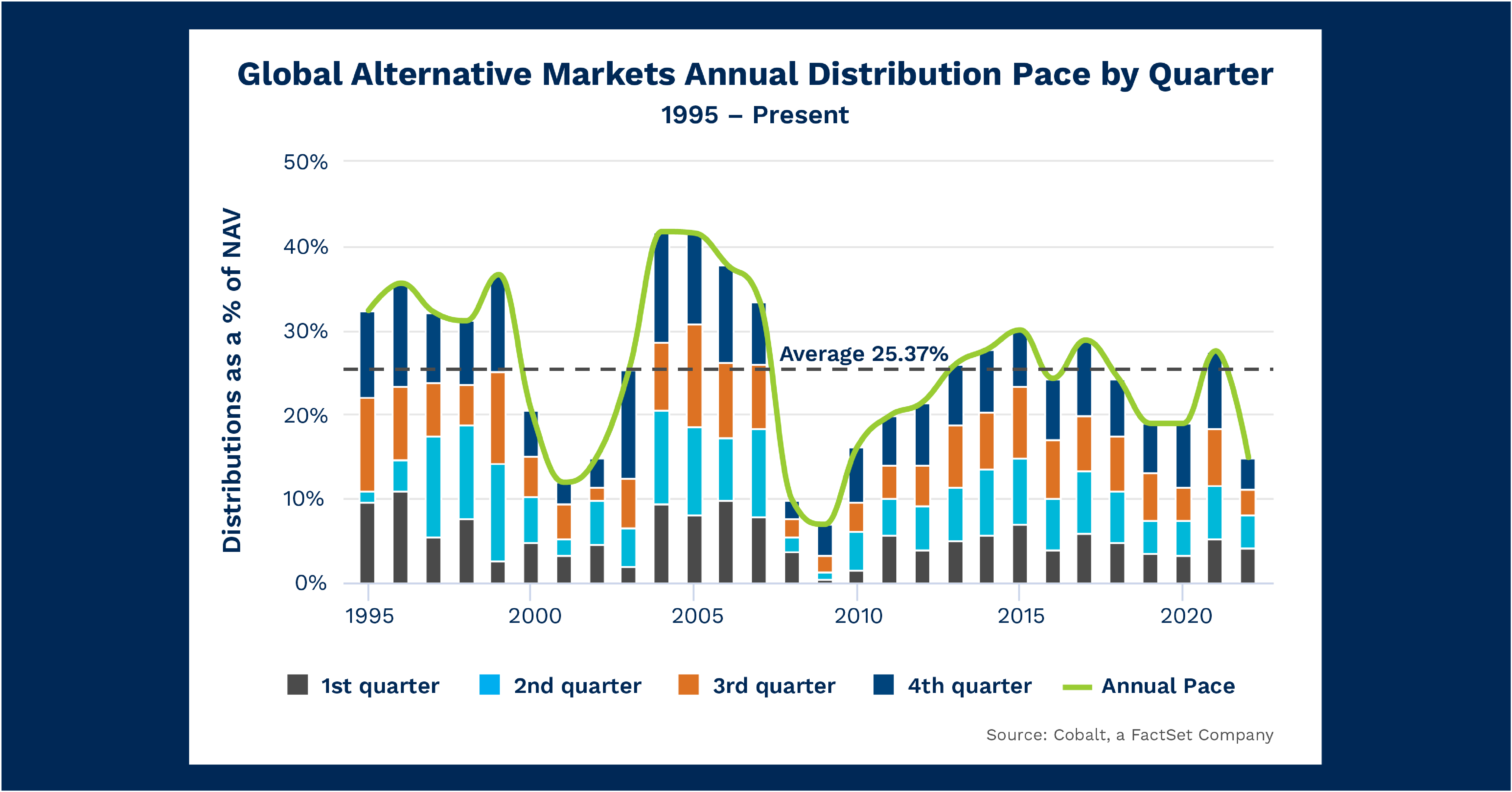

As a refresher, our distribution pace analysis calculates distributions as a percent of net asset value of private market funds. Now we’re able to include H2 (Q3 & Q4) in our analysis to measure how 2022 returns stack up to historical trends and to assess how accurate our predictions were back in February.

Key Takeaways

In Q3 2022, the average distribution pace of 3.1% was slightly below the 4% in Q2 2022. This tracks with the downturn across public markets in the same quarter (3Q22); the S&P 500 saw a 6.3% decline from July 1 to September 30. Additionally, this was the lowest third-quarter pace since 2008 to 2010, a stretch of time with sub-3.5% quarters each year.

Historically, the third quarter distribution pace is typically stronger than the first or second quarter. However, 2022 bucked the trend as the pace increased as the year progressed, with Q1 being the highest and subsequent quarters slowing.

Q4 finished above Q3 at a 3.7% pace, but it was still lower than the first two quarters of 2022. It was also the lowest Q4 rate since 2010 as there was a distribution rate of at least 5% throughout that timespan.

Overall, 2022’s average distribution pace of 14.9% is well below the previous 10-year average of 24.8%. The change in annual rate, along with the change in the typical quarter-to-quarter patterns in the market, shows that private equity was not immune to the economic uncertainty and volatility in the macro climate throughout that year.

Looking Ahead

It’s tough to draw a direct correlation, but the last two analyses reveal that public markets can signify the distribution pacing patterns in the private markets. Based on the S&P 500, there was a 7.5% increase in the public markets during the first quarter of 2023. This could signal an increase in private markets distribution pacing for 2023, although several factors could counteract this. In addition, the collapse of Silicon Valley Bank may weigh on distributions in the alternatives space, namely venture and growth verticals.

We will publish the Cobalt Q4 benchmark data in the coming weeks, at which point we can dig deeper into the overall trends of private markets in 2023.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…