Chart of the Month: November 2021

Birds of a Feather: A comparison of Growth Equity and Late-Stage Venture Capital

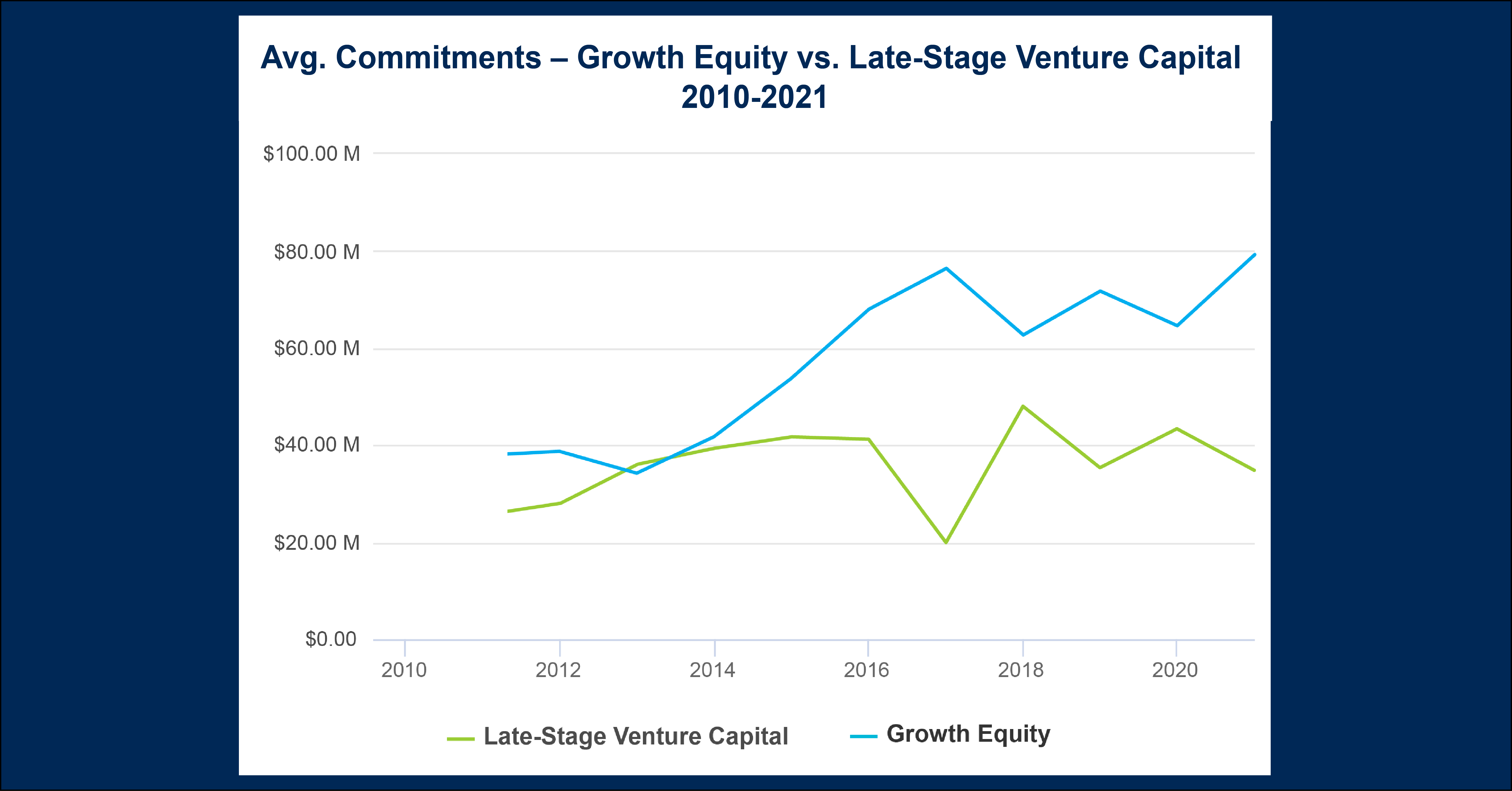

Growth Equity and post-seed Venture Capital are two styles often seen competing for the same deals within the private markets. This month’s chart uses Cobalt’s Market data set to take a deeper dive and understand the difference in how institutional investors approach these seemingly similar investment styles. To do this, we’ve taken the average commitment size for each style from 2010-2021 and plotted out how they have changed from year to year.

Key Takeaways:

- Growth Equity and Late-Stage Venture Capital commitments merged closer after the recession, with average VC commitments surpassing growth for the only time all decade in 2013. After this vintage year, the trends start to clearly diverge.

- In the past five to seven years, investors are leaning towards larger investments in growth equity, cutting larger and larger checks on average compared to late-stage VC investors.

- One explanation for this divergence is that Growth Equity is seen as a potentially safer investment compared to late-stage Venture funds. This is most apparent in 2017, 2019, and 2021, with over $40 million gaps in average commitments between the two styles.

Looking Ahead:

- This trend gap may persist as the world continues to navigate through COVID, since investors continue to see Growth Equity as the safer of the two investment options.

- An alternative scenario is a trend reversal, as late-stage tech startups may be better positioned to excel in a more remote world.

- Moreover, late-stage VC may be a beneficiary of recent trends in the market, as investors react to the IPO & SPAC frenzy of the past year by rotating back into the style.

- The popularity of credit funds and buyout funds looking to take advantage of distressed companies may also overtake commitments for the coming vintage years, which would leave less dry powder for Growth Equity and late-stage VC.

Subscribe to our blog:

Is There Geographic Bias in Macro Liquidity Trends in Private Markets?

Is There Geographic Bias in Macro Liquidity Trends in Private Markets? Building on our previous analysis of the role of…

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries

Private Equity Performance: Large Strategies Versus Funds of Funds, Co-Investments, and Secondaries In private equity, the large strategies of buyouts,…

Examining Tariff Policy Impacts on Private Fund Contribution Rates

Examining Tariff Policy Impacts on Private Fund Contribution Rates Recently we examined the impact of Latin America presidential elections—which carry presumptions…